What Protection Does the FSCS Offer for Investments in Crypto?

November 16, 2024 | by bestcrypto

Photo by Anne Nygård on Unsplash

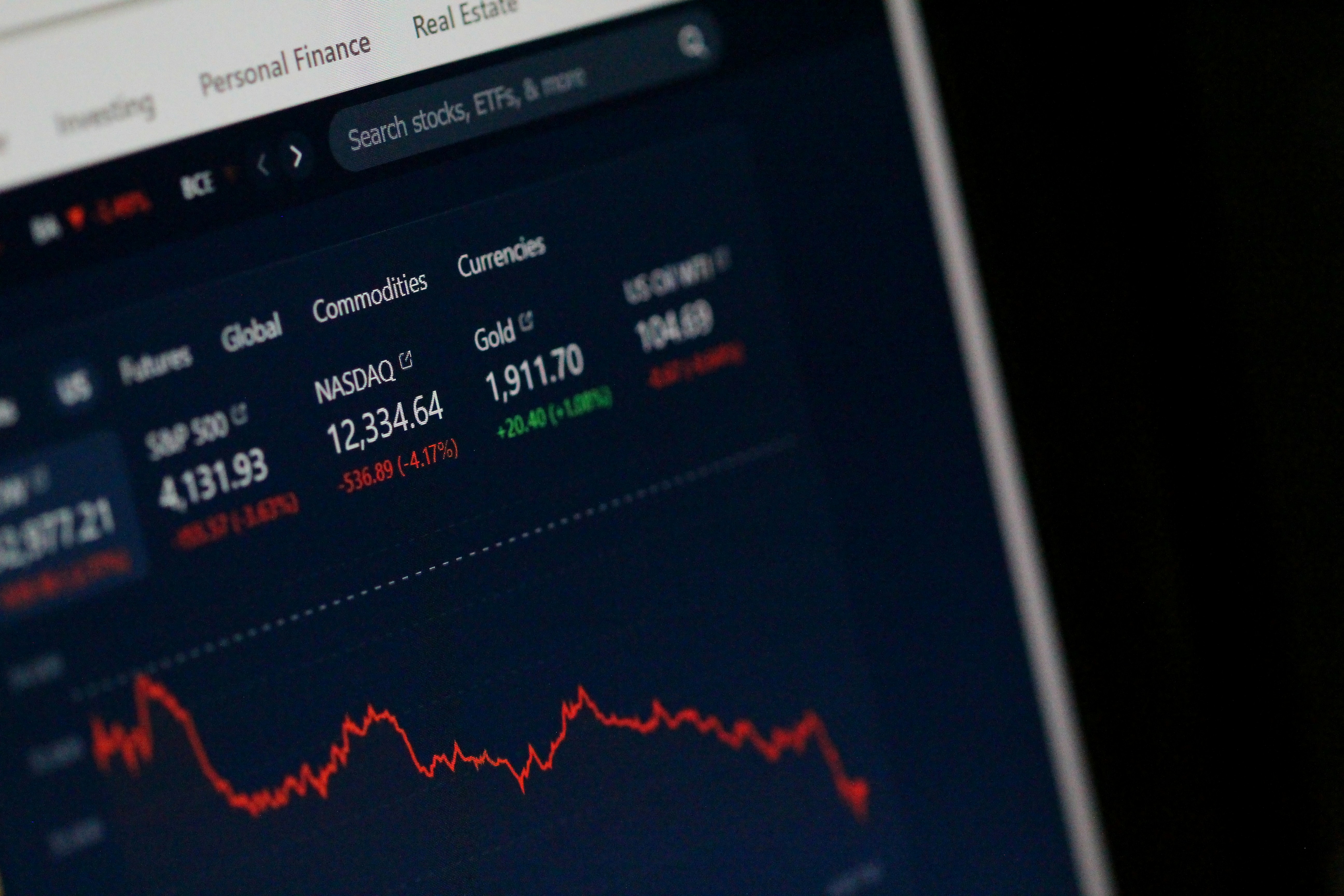

Photo by Anne Nygård on Unsplash In recent years, cryptocurrency has grown from a niche interest to a mainstream financial trend. But with its rise, questions of safety and regulation have become more pressing than ever. One common query is: What protection does the FSCS offer for investments in crypto? This question matters because many investors are unsure whether their money is secure if a crypto platform collapses. Let’s dive into the topic to understand the role of the Financial Services Compensation Scheme (FSCS) and what it means for crypto investments.

Understanding the FSCS and Its Purpose

The Financial Services Compensation Scheme (FSCS) is a UK-based protection system designed to safeguard consumers if financial firms fail. It acts as a safety net for investors, savers, and consumers of financial services, ensuring that they don’t lose everything in case of company insolvency or fraud.

Traditionally, the FSCS protects:

- Bank accounts.

- Mortgages.

- Insurance policies.

- Investments managed by authorized firms.

However, when it comes to cryptocurrency, things get trickier. Unlike traditional investments, cryptocurrencies operate in a decentralized environment, often outside the bounds of regular financial protections. This raises the question: What protection does the FSCS offer for investments in crypto?

FSCS Coverage: Crypto Investments vs. Traditional Investments

To answer the big question—what protection does the FSCS offer for investments in crypto—it’s crucial to differentiate between regulated financial products and the unregulated nature of most cryptocurrencies.

What the FSCS Covers:

- Traditional Investments: If you invest in stocks, shares, or bonds through a UK-regulated firm and that firm collapses, the FSCS may compensate you up to £85,000 per person per firm. This applies to situations where mismanagement, fraud, or insolvency occurs.

- Funds Held in Bank Accounts: If a crypto trading platform collapses but your funds were held in a UK-regulated bank account, the FSCS might protect those funds. This is because the protection applies to the bank, not the crypto itself.

What the FSCS Does Not Cover:

- Direct Crypto Investments: The FSCS does not typically cover losses arising from the fall in value of cryptocurrencies or the failure of a crypto-specific platform. Cryptocurrencies are not considered “financial products” in the traditional sense under UK law, leaving them outside FSCS protection.

In summary, while the FSCS provides robust protection for regulated investments, its coverage of crypto investments is minimal or non-existent. This makes understanding the risks of crypto trading even more critical.

Why Crypto Investments Are Not Fully Protected

The main reason why the FSCS does not offer protection for investments in crypto lies in the nature of cryptocurrencies themselves. Here’s why:

- Decentralization: Cryptocurrencies like Bitcoin and Ethereum operate on decentralized networks without any central authority, such as a bank or government, to oversee transactions. This makes them harder to regulate.

- Unregulated Market: Most cryptocurrencies and crypto exchanges are not regulated by the UK’s Financial Conduct Authority (FCA). The FSCS only covers products and firms that fall under FCA regulation.

- Volatility and Risk: Cryptocurrency prices are notoriously volatile. Protecting investors from losses due to price changes would be impractical for the FSCS, as it would involve covering highly speculative assets.

Are There Any Exceptions?

While what protection does the FSCS offer for investments in crypto largely concludes with “not much,” there are some exceptions worth noting.

Platforms With Regulated Services

Some crypto platforms offer regulated financial products alongside cryptocurrency trading. For example:

- E-wallet Services: If a platform holds your fiat currency (like GBP or USD) in a regulated e-wallet, that portion of your funds may be protected under FSCS guidelines.

- Investment Services: Platforms offering regulated investment services involving crypto-related securities could fall under FSCS protection.

Example:

If a UK-regulated investment firm offers exposure to cryptocurrency through an index or fund, and that firm collapses, the FSCS may cover your losses up to £85,000. However, the protection would apply to the firm’s failure—not to any drops in the value of the crypto.

Tips to Protect Yourself When Investing in Crypto

Understanding what protection does the FSCS offer for investments in crypto highlights the importance of taking personal steps to safeguard your investments. Here are some practical tips:

1. Research the Platform’s Credentials

- Always check if the platform you’re using is regulated by the FCA or similar bodies. A regulated platform offers more security for non-crypto assets and ensures better transparency.

2. Diversify Your Investments

- Avoid putting all your money into crypto. Balance your portfolio with traditional assets that are covered by FSCS or similar schemes.

3. Use Secure Wallets

- Store your crypto in secure wallets rather than leaving them on exchanges. Hardware wallets, for example, are less prone to hacking.

4. Understand the Risks

- Educate yourself about the volatility of cryptocurrencies. Only invest what you can afford to lose.

5. Seek Professional Advice

- If you’re unsure about how to proceed, consult a financial advisor who is familiar with both regulated and crypto investments.

Are There Alternatives to FSCS Protection for Crypto?

Since the FSCS offers limited protection for investments in crypto, you might wonder if there are alternative ways to protect yourself.

Crypto Insurance

Some exchanges offer insurance for funds stored on their platforms. While this is not the same as FSCS protection, it can provide some level of security against theft or hacking.

Third-Party Custodians

Certain third-party services specialize in securely storing cryptocurrencies. These services may have their own insurance policies to cover theft or loss.

Blockchain Features

Some blockchains have built-in safety mechanisms, like “smart contracts,” to ensure transactions occur as planned. While not foolproof, these features add a layer of security.

What Lies Ahead for Crypto Regulation?

As crypto becomes more popular, regulators worldwide are working on frameworks to ensure better consumer protection. In the UK, the FCA has begun regulating certain aspects of the crypto market, such as anti-money laundering (AML) compliance. While full FSCS protection for crypto investments may still be far off, increased regulation could pave the way for future safeguards.

Final Thoughts

So, what protection does the FSCS offer for investments in crypto? The short answer is very little. Cryptocurrencies remain largely unregulated and outside the scope of traditional financial safety nets like the FSCS. For investors, this underscores the need for caution, due diligence, and strategic planning.

If you’re considering diving into the crypto market, remember that the potential for high rewards comes with high risks. By staying informed and taking proactive steps to protect yourself, you can navigate the crypto world with greater confidence—knowing exactly where you stand when it comes to FSCS protection.

Legal Disclosure

This article is for informational purposes only and should not be considered legal or financial advice. While we have provided information on what provably fair means in crypto, we do not take responsibility for any decisions you make based on this information. Always conduct your research and consult with professionals before making any decisions regarding crypto gaming. Responsible gaming is essential, and we encourage players to only play on platforms they trust and understand.

RELATED POSTS

View all