What is a digital asset business? A digital asset business is essentially any enterprise that deals with assets existing purely in digital form, like cryptocurrencies, NFTs, or tokenized securities. These businesses leverage blockchain technology to create, manage, trade, or secure these digital assets. Think of exchanges where you buy and sell Bitcoin, platforms that allow you to lend out your crypto, or even companies building games with in-game items that are unique, verifiable digital assets. It’s a rapidly evolving space, constantly pushing the boundaries of what we consider ‘value’ in the digital age.

Diving Deep into Cryptocurrency Digital Assets

Cryptocurrency digital assets have undeniably reshaped the financial landscape, moving from niche interest to a global phenomenon. But what exactly are they, and why are they generating so much buzz? At its core, a cryptocurrency is a digital or virtual currency secured by cryptography, making it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers. This decentralization is a key differentiator from traditional financial systems, which are typically controlled by central authorities like banks or governments.

The Many Faces of Digital Assets

While Bitcoin and Ethereum often grab the headlines, the world of digital assets is far more diverse. Beyond cryptocurrencies, we have:

•Non-Fungible Tokens (NFTs): These are unique digital assets that represent ownership of real-world items like art, music, in-game items, and videos. Unlike cryptocurrencies, each NFT is one-of-a-kind and cannot be replaced by another identical item.

•Stablecoins: Designed to minimize price volatility, stablecoins are cryptocurrencies whose value is pegged to another asset, like the US dollar or gold. They offer the benefits of cryptocurrencies (fast transactions, global reach) without the wild price swings.

•Utility Tokens: These tokens grant users access to a specific product or service within a blockchain ecosystem. Think of them as digital coupons or licenses.

•Security Tokens: These are digital representations of traditional securities, like stocks or bonds, issued on a blockchain. They offer the potential for increased liquidity and fractional ownership.

Each type serves a different purpose, contributing to the rich and complex tapestry of the digital asset economy. The underlying technology, blockchain, provides the transparency, security, and immutability that makes these assets so revolutionary.

The Allure and the Risks: Why Digital Assets Matter

The appeal of cryptocurrency digital assets lies in several key areas:

•Decentralization: No single entity controls the network, reducing the risk of censorship or manipulation.

•Transparency: All transactions are recorded on a public ledger (the blockchain), making them verifiable and auditable.

•Security: Cryptographic techniques protect transactions and user identities.

•Accessibility: Anyone with an internet connection can participate, fostering financial inclusion.

•Efficiency: Transactions can be processed faster and at lower costs compared to traditional banking systems.

However, it’s not all smooth sailing. The world of digital assets also comes with its share of risks:

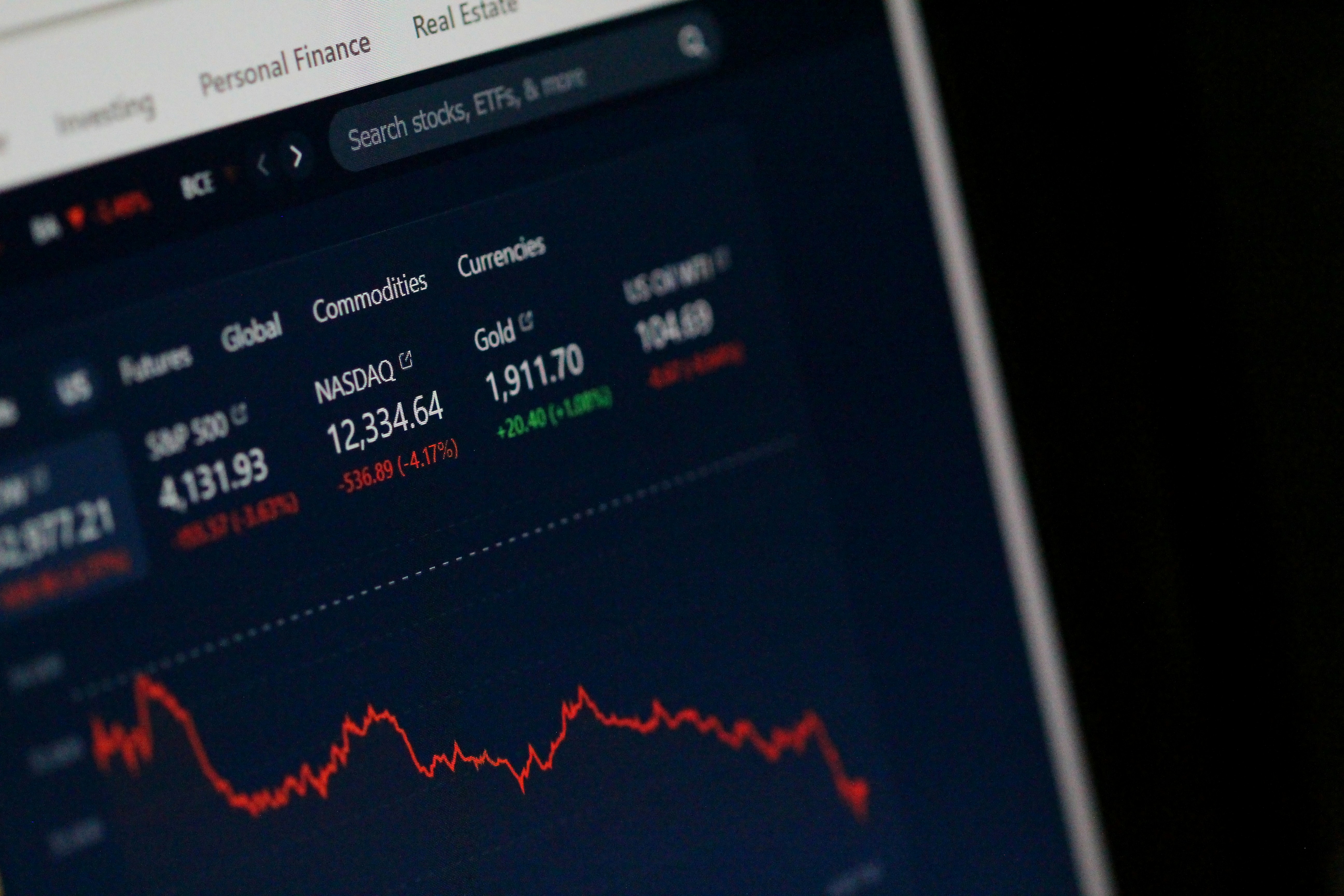

•Volatility: Prices can fluctuate wildly, leading to significant gains or losses.

•Regulatory Uncertainty: The legal landscape is still evolving, creating ambiguity and potential for sudden changes.

•Security Concerns: While the blockchain itself is secure, exchanges and individual wallets can be vulnerable to hacks and scams.

•Complexity: Understanding the technology and navigating the ecosystem can be challenging for newcomers.

•Environmental Impact: The energy consumption of some proof-of-work cryptocurrencies (like Bitcoin) is a growing concern.

Navigating this landscape requires careful research, a clear understanding of your risk tolerance, and a commitment to continuous learning.

The Future is Digital: What’s Next for Digital Assets?

The trajectory of cryptocurrency digital assets points towards an increasingly integrated future with traditional finance and everyday life. We’re already seeing major financial institutions exploring blockchain technology for everything from cross-border payments to asset tokenization. Central banks worldwide are researching and even launching their own Central Bank Digital Currencies (CBDCs), which could revolutionize national monetary systems.

Beyond finance, digital assets are poised to transform industries like gaming, supply chain management, and intellectual property. Imagine truly owning your in-game purchases, tracking products from farm to table with immutable records, or artists receiving royalties directly and transparently for their work. The concept of Web3, a decentralized internet built on blockchain, promises a future where users have more control over their data and digital identities.

Of course, challenges remain. Scalability, regulatory clarity, and user-friendliness are crucial hurdles to overcome for widespread adoption. However, the innovation in this space is relentless, with developers constantly building new solutions and applications. The conversation has shifted from ‘if’ digital assets will play a significant role to ‘how’ they will continue to evolve and integrate into our global economy. It’s an exciting time to witness this digital revolution unfold.

Frequently Asked Questions (FAQs)

Q1: What’s the difference between a cryptocurrency and a digital asset? A1: A cryptocurrency is a type of digital asset, specifically one designed to work as a medium of exchange using cryptography to secure transactions and control the creation of new units. Digital assets are a broader category that includes cryptocurrencies, but also NFTs, tokenized securities, and any other asset that exists purely in digital form.

Q2: Is investing in digital assets safe? A2: Investing in digital assets carries significant risks, including high volatility, regulatory uncertainty, and potential for hacks or scams. It’s crucial to do your own research, understand the risks involved, and only invest what you can afford to lose. Security measures like hardware wallets can help protect your assets.

Q3: How do I buy cryptocurrency digital assets? A3: You can buy cryptocurrency digital assets through various platforms, including centralized exchanges (like Coinbase or Binance), decentralized exchanges (DEXs), or peer-to-peer (P2P) marketplaces. The process typically involves creating an account, verifying your identity, and linking a payment method.

Q4: What is blockchain technology? A4: Blockchain is a decentralized, distributed ledger technology that records transactions across many computers. Each ‘block’ in the chain contains a list of transactions, and once recorded, it’s very difficult to change. This technology underpins most cryptocurrencies and many other digital assets, providing transparency and security.

Q5: Are digital assets regulated? A5: The regulation of digital assets varies significantly across different countries and jurisdictions, and it’s an evolving area. Some countries have clear frameworks, while others are still developing their approach. This regulatory uncertainty can impact the legality and stability of certain digital assets.

RELATED POSTS

View all