Is there a bubble in cryptocurrency? This is a question that has been asked repeatedly throughout the history of digital assets, and the answer is complex, often depending on who you ask and what their perspective is. A financial bubble, generally speaking, occurs when the price of an asset or asset class rises rapidly and significantly, driven by speculation rather than intrinsic value, eventually leading to a sharp and sudden collapse. The cryptocurrency market, with its dramatic price swings and periods of irrational exuberance, certainly exhibits characteristics that lead many to label it as a bubble, or a series of bubbles.

Understanding the Bubble Phenomenon

Financial bubbles are not new; history is replete with examples, from the Dutch Tulip Mania in the 17th century to the Dot-com bubble of the late 1990s. They typically follow a pattern:

1.Displacement: A new paradigm or technology emerges, creating new opportunities. In crypto, this was the invention of Bitcoin and blockchain technology.

2.Boom: Prices rise, attracting early investors and media attention. This draws in more investors, leading to a self-fulfilling prophecy of rising prices.

3.Euphoria: Public participation becomes widespread, often driven by fear of missing out (FOMO). Prices detach from fundamentals, and speculation becomes rampant.

4.Profit-Taking/Panic: Smart money starts to exit, and eventually, a trigger event (regulatory news, a major hack, or simply a loss of confidence) causes prices to plummet.

Why Crypto is Often Labeled a Bubble

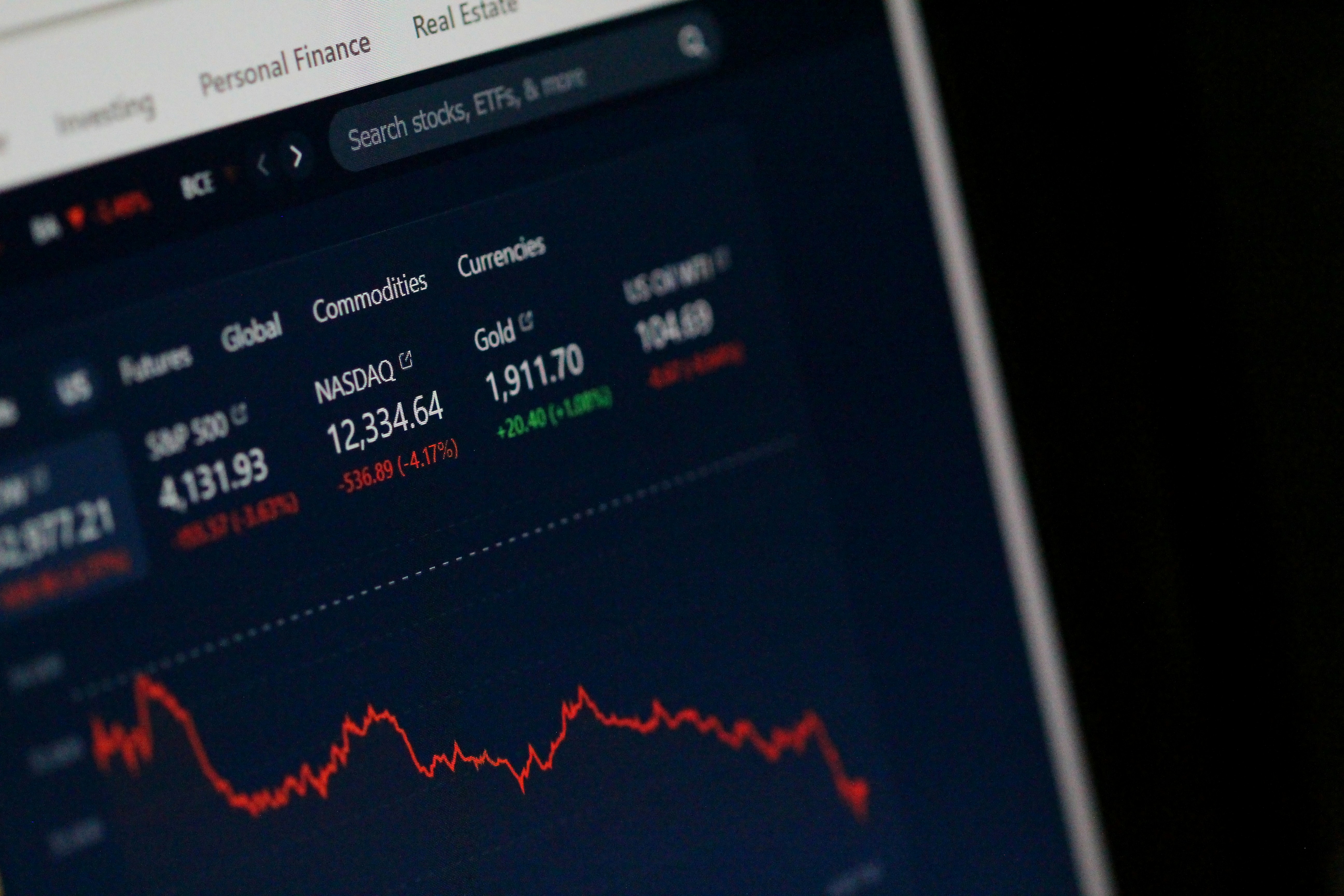

The cryptocurrency market has experienced several cycles that fit this description. Bitcoin, and subsequently many altcoins, have seen parabolic rises followed by significant corrections. Critics point to several factors:

•Lack of Intrinsic Value (Perceived): Unlike traditional assets like stocks (representing ownership in a company with earnings) or bonds (representing a claim on future cash flows), many cryptocurrencies don’t have easily quantifiable intrinsic value. Their value is often derived from network effects, adoption, and speculative demand.

•Speculative Nature: A large portion of cryptocurrency trading is driven by speculation, with investors buying in hopes of quick profits rather than long-term utility or fundamental growth.

•Rapid Price Appreciation: The speed and magnitude of price increases in crypto are often unprecedented in traditional markets, leading to concerns about sustainability.

•Retail Investor Dominance: While institutional adoption is growing, a significant portion of the market is still driven by retail investors, who can be more susceptible to emotional trading and herd mentality.

Counterarguments and Nuances

However, many in the crypto community argue against the blanket label of

a “bubble.” They emphasize the revolutionary potential of blockchain technology and the growing utility of cryptocurrencies:

•Technological Innovation: Blockchain technology offers decentralized, transparent, and secure ways to manage data and transactions, with applications far beyond just digital money. This underlying innovation provides a fundamental value that wasn’t present in previous bubbles like the Tulip Mania.

•Growing Adoption and Utility: Cryptocurrencies are increasingly being used for real-world applications, including remittances, decentralized finance (DeFi), non-fungible tokens (NFTs), and supply chain management. As more use cases emerge and adoption grows, the fundamental value of these networks increases.

•Scarcity and Halving Events: For cryptocurrencies like Bitcoin, programmed scarcity (like the halving events that reduce the supply of new Bitcoins) can create legitimate supply-side pressure that drives up prices, similar to precious metals.

•Maturing Market Infrastructure: The cryptocurrency market has seen significant development in infrastructure, including regulated exchanges, institutional investment products (like Bitcoin ETFs), and clearer regulatory frameworks in some jurisdictions. This maturation suggests a move beyond pure speculation.

The Difference Between a Bubble and a Correction

It’s important to distinguish between a speculative bubble and a healthy market correction. Corrections are normal in any financial market, where prices pull back after rapid gains to consolidate before potentially moving higher. Bubbles, on the other hand, imply a complete collapse where prices never recover to previous highs because the underlying asset had no real value. While the crypto market has experienced dramatic crashes, assets like Bitcoin have historically recovered and surpassed previous all-time highs, suggesting that these were more akin to severe corrections rather than outright bubble bursts.

Navigating the Volatility

For investors, understanding the potential for bubbles and corrections is crucial. The cryptocurrency market is inherently volatile, and significant price swings are to be expected. Diversification, investing only what you can afford to lose, and focusing on long-term fundamentals rather than short-term price movements are often cited as key strategies for navigating this space. The debate over whether crypto is a bubble will likely continue, but what’s clear is that the technology and its applications are here to stay, evolving rapidly and challenging traditional financial paradigms.

Preguntas Frecuentes (FAQs)

What is a financial bubble?

A financial bubble occurs when the price of an asset inflates rapidly and unsustainably, driven by speculation rather than its true value, eventually leading to a sharp price collapse.

Has the cryptocurrency market experienced bubbles?

Many analysts believe the cryptocurrency market has experienced several periods that resemble bubbles, characterized by rapid price increases followed by significant corrections. However, some argue these are more accurately described as market cycles or corrections due to the underlying technological innovation and subsequent price recoveries.

What are the signs of a bubble in crypto?

Signs often include rapid, unsustainable price increases, widespread public participation driven by FOMO (Fear Of Missing Out), a disconnect between price and fundamental utility, and a high degree of speculative trading.

Is Bitcoin a bubble?

Bitcoin has experienced periods of rapid price appreciation and subsequent corrections, leading some to label it a bubble. However, proponents argue that its underlying technology, limited supply, and growing adoption provide fundamental value, suggesting that its price movements are part of a volatile but maturing market.

How can investors protect themselves from a crypto bubble burst?

Strategies include diversifying investments, only investing what you can afford to lose, conducting thorough research on projects, focusing on long-term utility rather than short-term speculation, and being aware of market sentiment.

Disclaimer: Not Financial Advice

The information provided in this article is for informational and educational purposes only. It does not constitute financial, investment, trading, or any other advice. Investing in cryptocurrencies carries a high level of risk and may not be suitable for all investors. Before making any investment decisions, you should seek advice from a qualified financial professional. Any decisions you make based on the information in this document are at your own risk. We are not responsible for any loss or damage that may arise from reliance on the information contained herein.

RELATED POSTS

View all