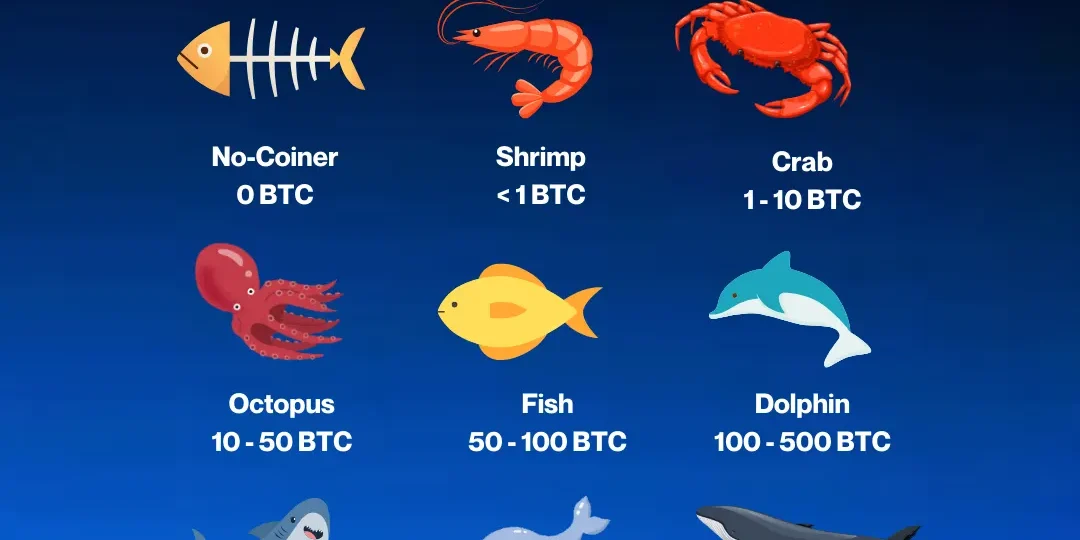

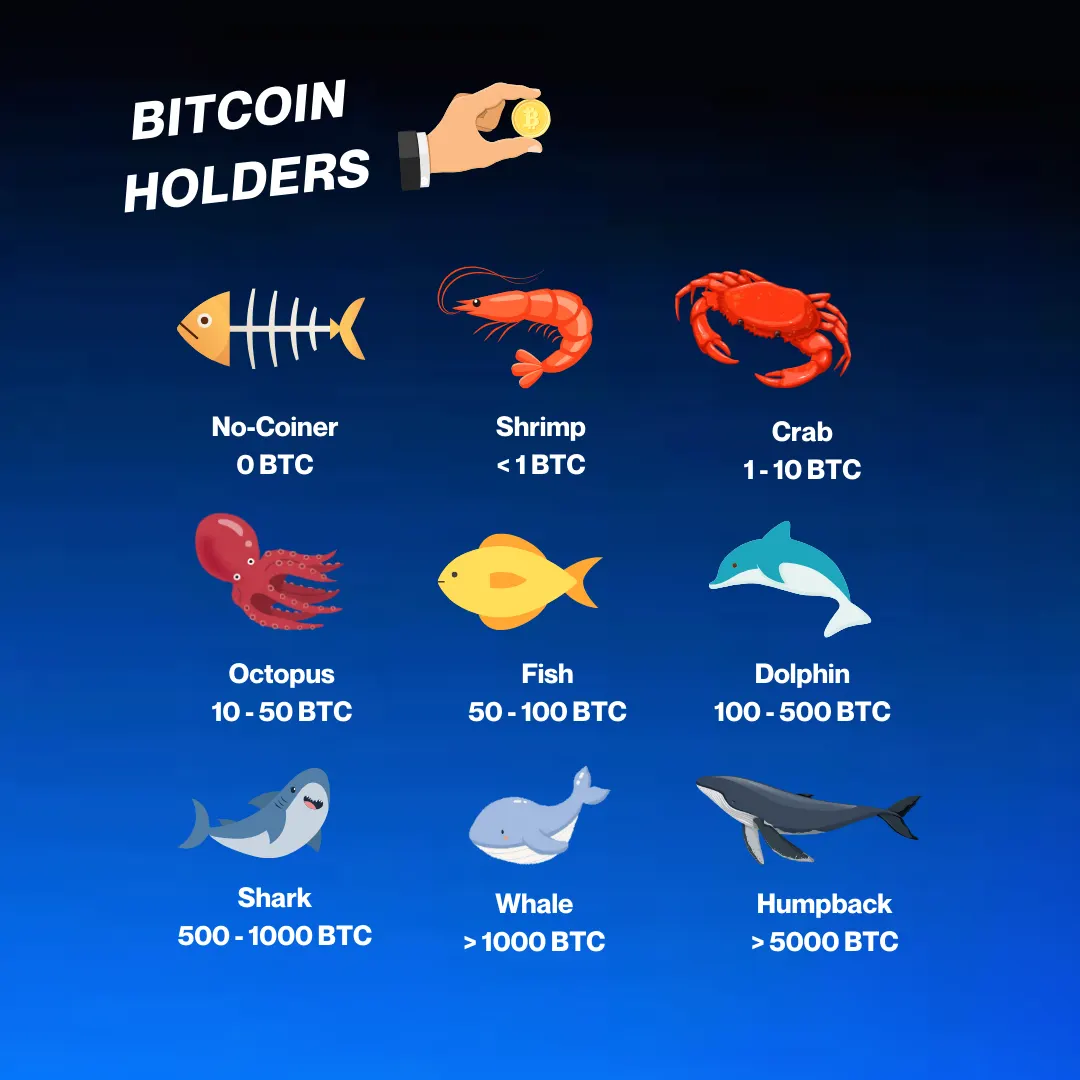

The Bitcoin Rich List refers to a compilation of Bitcoin addresses holding the largest amounts of BTC, essentially showcasing the wealthiest individuals and entities in the Bitcoin ecosystem. It’s a fascinating peek into the distribution of wealth within the world of cryptocurrency, and it often sparks curiosity about who these

Bitcoin ‘whales’ are, and what their holdings mean for the market.

What is the Bitcoin Rich List?

At its core, the Bitcoin Rich List is a ranking of Bitcoin addresses by the amount of Bitcoin they hold. Because the Bitcoin blockchain is transparent, anyone can view the balances of all Bitcoin addresses. However, it’s important to understand that these addresses are pseudonymous. While you can see the amount of Bitcoin held in a particular address, you can’t directly identify the person or entity behind it without additional information. This means the ‘rich list’ is more about the distribution of Bitcoin across addresses rather than a definitive list of individual billionaires.

Who are the Bitcoin Whales?

The term ‘Bitcoin whales’ is commonly used to describe individuals or entities holding a significant amount of Bitcoin, often enough to potentially influence market prices with their trades. These can include:

•Satoshi Nakamoto: The anonymous creator(s) of Bitcoin is believed to hold a substantial amount of BTC, estimated to be around 1 million Bitcoins, which have remained untouched since the early days.

•Cryptocurrency Exchanges: Major exchanges like Binance, Coinbase, and Kraken hold vast amounts of Bitcoin on behalf of their users. These are often among the largest addresses on the rich list, but they represent collective holdings, not a single owner.

•Institutional Investors: As Bitcoin gains mainstream acceptance, more institutional players like MicroStrategy, Tesla, and various investment funds are accumulating significant amounts of Bitcoin as part of their treasury reserves or investment portfolios.

•Early Adopters and Miners: Many individuals who got into Bitcoin in its early days, either by mining it or purchasing it when prices were extremely low, now hold substantial amounts.

•Governments: Some governments have seized Bitcoin from criminal activities and now hold considerable amounts.

Why Does the Bitcoin Rich List Matter?

The Bitcoin Rich List is more than just a curiosity; it provides valuable insights into the market:

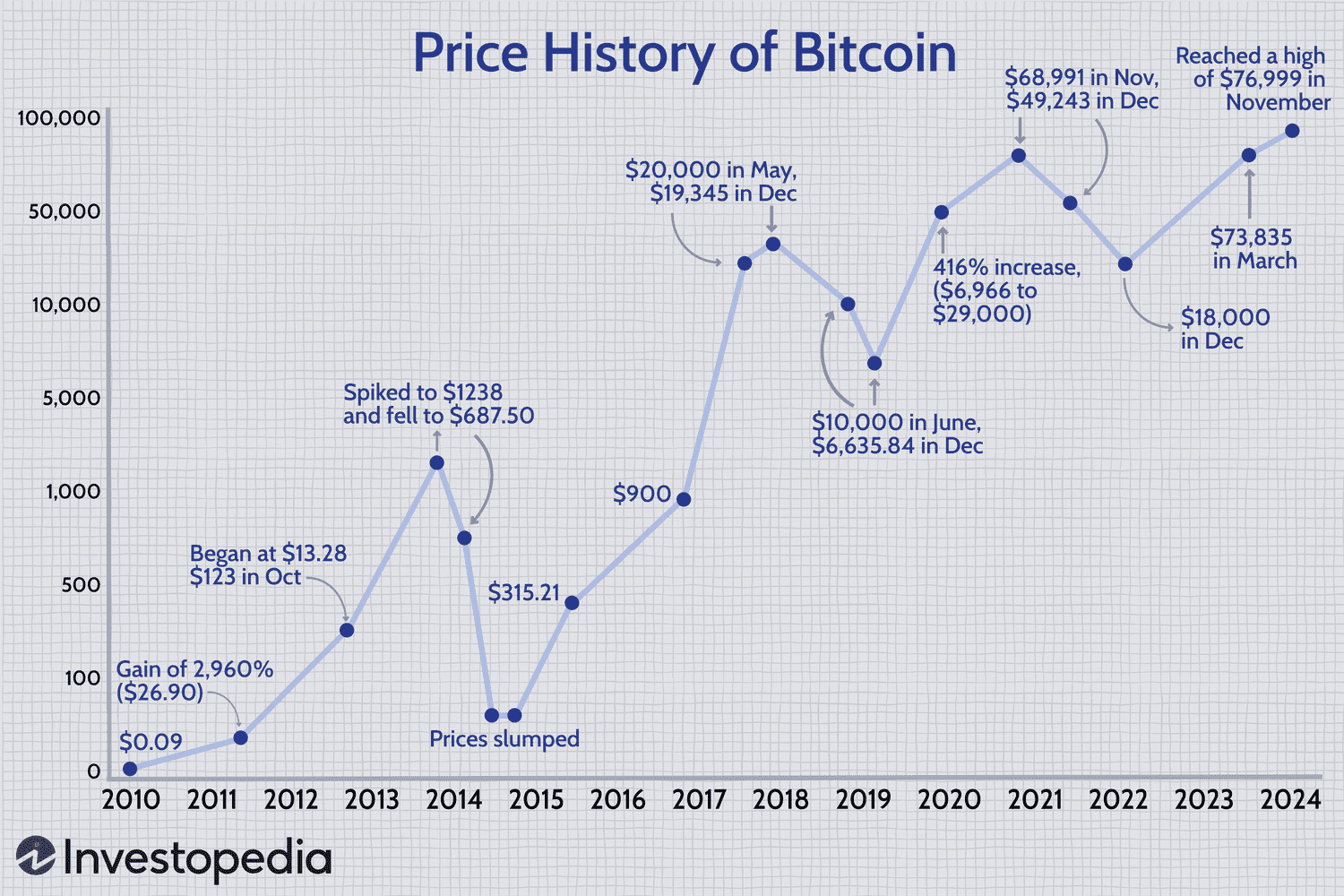

•Market Influence: The actions of large holders, or ‘whales,’ can significantly impact Bitcoin’s price. If a whale decides to sell a large portion of their holdings, it can create downward pressure on the market. Conversely, large purchases can drive prices up.

•Decentralization Concerns: A highly concentrated distribution of Bitcoin raises questions about decentralization. If a small number of entities control a large percentage of the supply, it could theoretically lead to concerns about market manipulation or undue influence.

•Liquidity: The movement of large amounts of Bitcoin by whales can affect market liquidity. When whales move their coins to exchanges, it might signal an intent to sell, increasing supply and potentially lowering prices.

•Long-Term HODLers vs. Traders: Analyzing the activity of these large addresses can sometimes differentiate between long-term holders (HODLers) who are accumulating and those who are actively trading.

Limitations and Nuances

While the Bitcoin Rich List offers a glimpse into Bitcoin distribution, it’s crucial to understand its limitations:

•Single Entity, Multiple Addresses: One individual or entity can control multiple Bitcoin addresses. So, an address appearing on the rich list doesn’t necessarily mean it’s a unique owner. A single whale might spread their holdings across many addresses for security or privacy reasons.

•Custodial Holdings: As mentioned, many large addresses belong to exchanges or custodians holding Bitcoin on behalf of millions of users. These are not individual fortunes.

•Privacy Measures: Advanced users and institutions employ various privacy techniques, such as address reuse avoidance and CoinJoin transactions, which can make it harder to accurately track and consolidate holdings.

•Dynamic Nature: The rich list is constantly changing as Bitcoin is bought, sold, and moved between addresses. A snapshot at any given time might not reflect the full picture.

In conclusion, the Bitcoin Rich List is a fascinating, albeit complex, aspect of the cryptocurrency world. It highlights the significant wealth accumulated by early adopters and institutional players, while also underscoring the transparent yet pseudonymous nature of the blockchain. Understanding its dynamics can offer valuable insights into market sentiment and potential price movements, but it should always be viewed with an awareness of its inherent limitations.

FAQs

Q: Can I see who owns a specific Bitcoin address? A: No, Bitcoin addresses are pseudonymous. While you can see the balance and transactions of an address on the blockchain, you cannot directly identify the owner without additional off-chain information.

Q: What is a Bitcoin whale? A: A Bitcoin whale is an individual or entity that holds a very large amount of Bitcoin, typically enough to potentially influence the market price with their trades.

Q: Does the Bitcoin Rich List include all Bitcoin holders? A: The rich list shows addresses with significant holdings, but it doesn’t necessarily represent every single Bitcoin holder. Many individuals hold smaller amounts, and some large holders might distribute their Bitcoin across multiple addresses.

Q: How does the Bitcoin Rich List affect the market? A: The movements of large Bitcoin holders (whales) can impact market sentiment and price. Large sales can lead to price drops, while large purchases can drive prices up.

Q: Is the Bitcoin Rich List a real-time list? A: Yes, the data for the Bitcoin Rich List is derived from the transparent Bitcoin blockchain, which is constantly updated. However, the interpretation and compilation into a ‘rich list’ by various platforms might have slight delays or different methodologies.

Disclaimer: Not Financial Advice

RELATED POSTS

View all