If you’re looking to turn your Ethereum (ETH) from just sitting in your wallet into a passive income generator—while keeping your keys safe—then staking with your Ledger Nano S is one of the most powerful moves you can make. In this article I’ll walk you through why staking matters, how to stake using Ledger, the risks to watch, and some hacks to make the process smooth.

Why Stake ETH?

- Ethereum now uses a Proof-of-Stake (PoS) consensus model: by staking ETH you help secure the network and in return you earn rewards.

- With Ledger’s integration you get self-custody (your private keys stay with you) + staking rewards.

- The returns are real: while they vary by network conditions, staking rewards for ETH are being offered in the ~3-4% range (and can change).

Step-by-Step: Staking ETH with Ledger Nano S

Here’s how to do it in clear steps. Make sure you follow carefully to avoid mistakes.

1. Make sure you’re up to date

- Ensure your Ledger Nano S firmware is the latest version.

- Install and open the Ledger Live app on your computer (or mobile if supported).

- In Ledger Live, install the Ethereum app on your device, and add an Ethereum account if you haven’t yet.

2. Transfer ETH into your Ledger account

- If your ETH is on an exchange or another wallet, send it to the Ethereum address in your Ledger account.

- Make sure you leave a small extra ETH to cover gas/transaction fees.

3. Choose your staking method

With Ledger you have a few ways to stake your ETH:

- Native staking (solo or via a validator): If you have (or want to commit) 32 ETH, you can run a validator node or delegate to one.

- Pooled or liquid staking: If you don’t have 32 ETH, Ledger supports partner validators and liquid staking services (e.g., Lido) that let you start with smaller amounts.

4. Start staking via Ledger Live

Here’s the typical flow for a liquid staking / partner validator path:

- Open Ledger Live → navigate to the “Discover” or “Earn” tab.

- Select Ethereum (ETH) as your asset.

- Choose a staking provider (e.g., Lido, Kiln, etc).

- Enter the amount of ETH you want to stake.

- Confirm the details (validator, fees, lock-up / liquidity conditions) on Ledger Live and approve on the device itself.

- After confirmation, your staking transaction is broadcast.

5. Monitor rewards & your stake

- Once staking is active, you’ll see your rewards accumulating (depending on the provider, some rewards appear as separate tokens, e.g., stETH for Lido).

- Keep an eye on your validator’s uptime / performance if doing native staking (poor performance can impact rewards).

6. Unstaking / withdrawing

- For native staking: after the appropriate network upgrades / exit queue you can withdraw your staked ETH + rewards.

- For liquid staking (e.g., Lido): you may be able to swap back your derivative token (like stETH) back to ETH when the market and network allow.

Tips & Hacks for Maximising Success

- Security first: Always verify you’re using the official Ledger Live app and your device firmware is up to date. The hardware wallet protects your keys, which is the top security layer.

- Start small if unsure: If you’re new to staking, use a smaller amount and a liquid staking provider so you can get used to the process, before committing large sums.

- Check validator reputation: If you choose a less-known staking provider or validator, check their uptime, history of slashing (if any), transparency.

- Understand lock-up / liquidity: Native staking may involve your ETH being locked for a period; liquid staking gives more flexibility but may have different risks.

- Gas fees matter: Even with staking, make sure you leave enough ETH for future transactions / unstaking.

- Tax & accounting: Depending on your jurisdiction, staking rewards might be taxable. This is extra important if you receive derivative tokens like stETH. (See Reddit threads on staking tax implications.)

Risks & What Could Go Wrong

- Slashing / validator penalty: For native staking, if your validator misbehaves, you could lose part of your stake.

- Smart contract risk: With liquid staking / pooled setups, you rely on smart contracts; bugs or vulnerabilities may exist.

- Liquidity constraints: Some staking options lock up your ETH for a while; you may not be able to withdraw immediately or without fees/penalties.

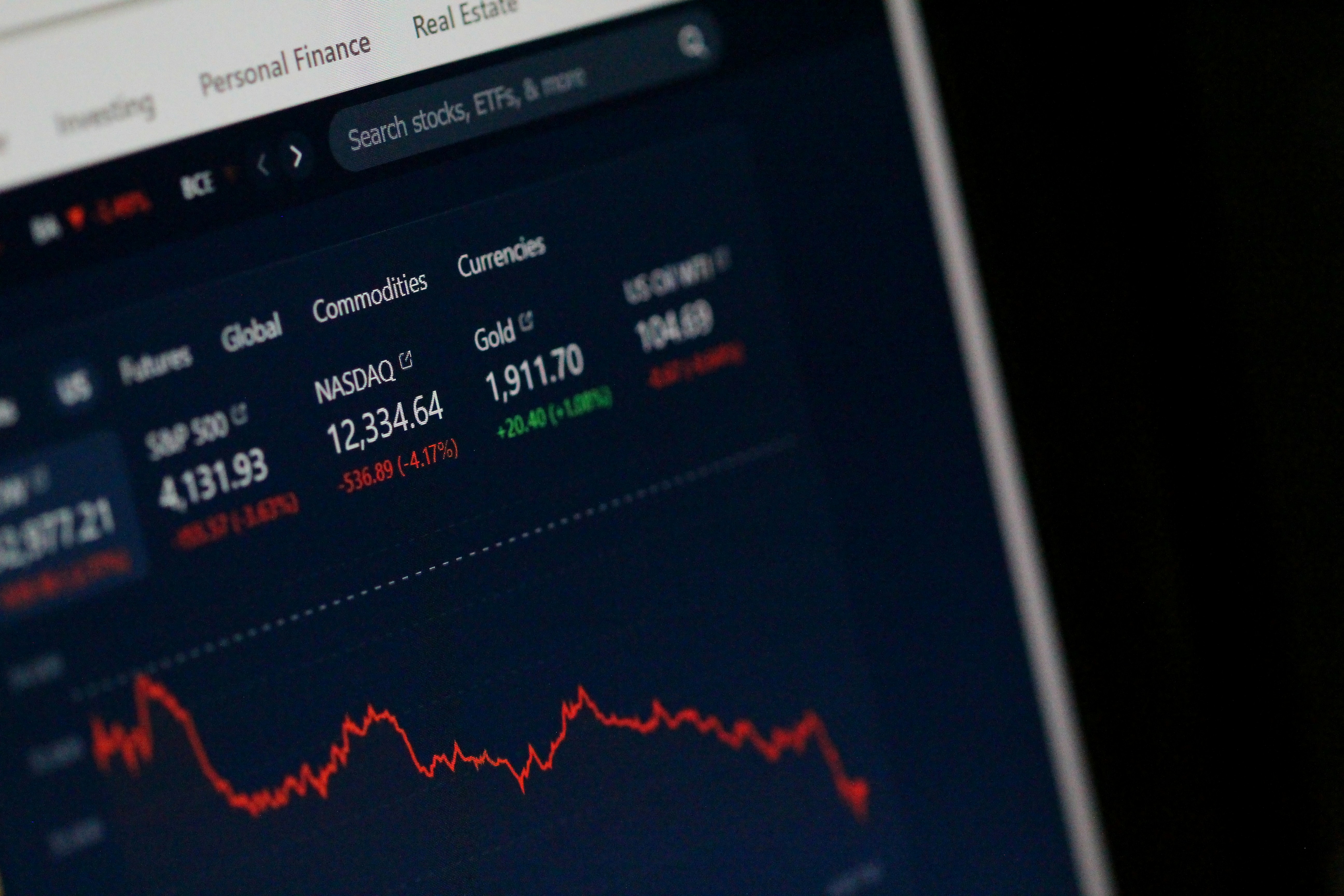

- Market risk: ETH price is volatile; staking rewards may not offset a large decline in ETH’s value.

- Custody missteps: If you lose your seed phrase, or your device is compromised, staking doesn’t protect you from that. Always keep your backup safe.

Final Thoughts

Staking ETH with your Ledger Nano S is a smart move if you understand what you’re doing. It combines strong security (hardware wallet), with the ability to earn passive rewards while contributing to the Ethereum network. The key is to follow the steps carefully, pick a staking method that fits your budget and risk tolerance, and stay informed.

If I were to summarise: Set up your Ledger ✅ Transfer ETH ✅ Choose the right staking path ✅ Monitor & secure ✅ Enjoy rewards.

RELATED POSTS

View all