The Complete Guide to Investing in Bitcoin ETFs: Everything You Need to Know in 2025

May 16, 2025 | by bestcrypto

In the ever-evolving landscape of cryptocurrency investments, 2025 stands as a landmark year for Bitcoin enthusiasts and traditional investors alike. The approval and subsequent expansion of Bitcoin Exchange-Traded Funds (ETFs) have fundamentally transformed how individuals and institutions can gain exposure to the world’s leading cryptocurrency. No longer confined to cryptocurrency exchanges or digital wallets, Bitcoin has found its way into mainstream investment portfolios through regulated, accessible investment vehicles.

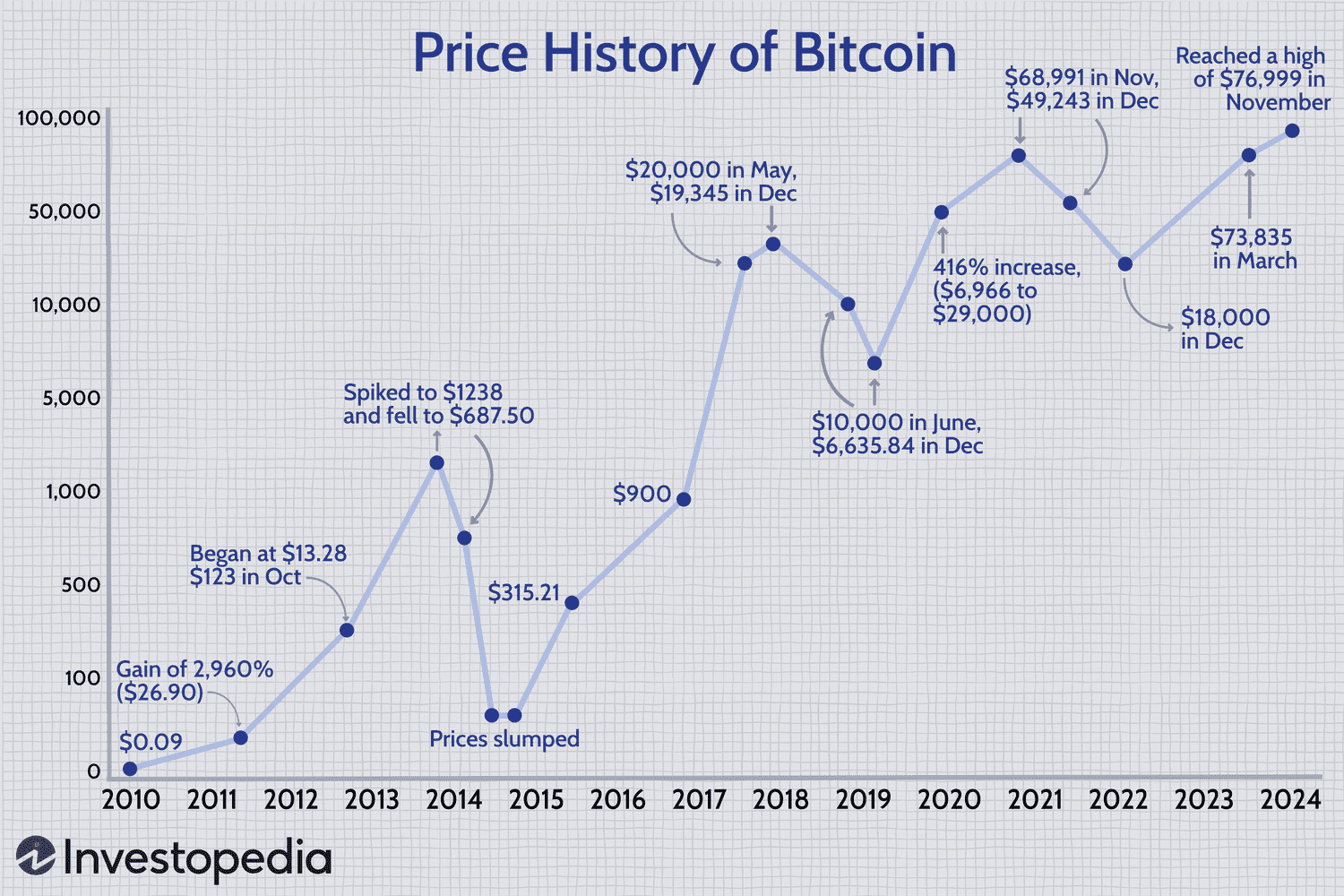

Bitcoin’s journey from a niche digital asset to a cornerstone of modern investment strategies has been nothing short of remarkable. After reaching unprecedented heights of $100,000 in 2024 and continuing its upward trajectory in 2025, Bitcoin has captured the attention of financial markets worldwide. At the heart of this transformation lies the Bitcoin ETF—a revolutionary financial instrument that bridges the gap between traditional finance and the cryptocurrency frontier.

This comprehensive guide aims to equip you with everything you need to know about investing in Bitcoin ETFs in 2025. Whether you’re a seasoned investor looking to diversify your portfolio or a newcomer curious about gaining exposure to Bitcoin without the complexities of direct ownership, this article will provide you with the knowledge, strategies, and insights necessary to navigate the Bitcoin ETF landscape confidently.

The significance of Bitcoin ETFs cannot be overstated. They represent a watershed moment in cryptocurrency investment, offering a regulated, secure, and accessible pathway to Bitcoin exposure. Through these investment vehicles, the barriers to entry that once deterred traditional investors—complex wallets, security concerns, and regulatory uncertainties—have been substantially lowered.

As we delve into the intricacies of Bitcoin ETFs, we’ll explore their mechanics, compare the leading providers, analyze investment strategies, assess risks, and examine future prospects. By the end of this guide, you’ll have a thorough understanding of how Bitcoin ETFs work, how to select the right one for your investment goals, and how to incorporate them effectively into your broader investment strategy.

The cryptocurrency landscape continues to evolve rapidly, and staying informed is crucial for making sound investment decisions. This guide represents your comprehensive resource for navigating the exciting yet complex world of Bitcoin ETFs in 2025. Let’s embark on this journey together, exploring the transformative potential of these innovative investment vehicles in the ever-changing financial landscape.

Understanding Bitcoin ETFs: The Basics

Bitcoin Exchange-Traded Funds (ETFs) represent one of the most significant developments in cryptocurrency investment history. To fully appreciate their impact and potential, it’s essential to understand what they are, how they work, and the journey that led to their approval and widespread adoption in the financial markets.

What is a Bitcoin ETF and How Does It Work?

A Bitcoin ETF is a financial instrument that tracks the price of Bitcoin and trades on traditional stock exchanges, just like shares of stock. Unlike direct Bitcoin ownership, which requires managing digital wallets and private keys, Bitcoin ETFs allow investors to gain exposure to Bitcoin’s price movements through a regulated, familiar investment vehicle.

When you purchase shares of a Bitcoin ETF, you’re not directly buying Bitcoin. Instead, you’re investing in a fund that holds Bitcoin as its underlying asset. The ETF issuer maintains custody of the actual Bitcoin, handling the security and storage concerns that often deter traditional investors from direct cryptocurrency ownership.

This structure offers several advantages. First, it eliminates the technical barriers to entry, as investors can buy and sell ETF shares through their existing brokerage accounts using familiar trading platforms. Second, it provides a regulated investment option with institutional-grade security measures. Third, it simplifies tax reporting, as ETF investments fit within established tax frameworks for securities.

Spot Bitcoin ETFs vs. Futures-Based ETFs

It’s crucial to distinguish between two types of Bitcoin ETFs: spot ETFs and futures-based ETFs.

Spot Bitcoin ETFs directly hold Bitcoin as their underlying asset. They aim to track the current “spot” price of Bitcoin as closely as possible. When you invest in a spot Bitcoin ETF, your investment is backed by actual Bitcoin held in custody by the fund. This direct ownership structure typically results in more accurate price tracking.

Futures-based Bitcoin ETFs, on the other hand, hold Bitcoin futures contracts rather than actual Bitcoin. These contracts represent agreements to buy or sell Bitcoin at a predetermined price on a specified future date. While futures-based ETFs provide exposure to Bitcoin’s price movements, they can experience “tracking error” due to the costs of rolling over futures contracts and the potential divergence between futures prices and spot prices.

The distinction is significant because spot Bitcoin ETFs generally provide more direct exposure to Bitcoin’s price movements, while futures-based ETFs may be subject to additional costs and tracking discrepancies. In 2025, spot Bitcoin ETFs have become the preferred choice for most investors seeking pure Bitcoin exposure.

How Bitcoin ETFs Track the Price of Bitcoin

Spot Bitcoin ETFs employ a straightforward mechanism to track Bitcoin’s price. The fund manager purchases and holds Bitcoin in proportion to the fund’s assets under management. As investors buy shares of the ETF, the fund manager acquires more Bitcoin; as investors sell shares, the manager may liquidate some Bitcoin holdings.

The net asset value (NAV) of the ETF is calculated based on the current market value of the fund’s Bitcoin holdings, divided by the number of outstanding ETF shares. While the ETF’s market price should theoretically match its NAV, supply and demand dynamics can sometimes create temporary premiums or discounts.

To ensure accurate price tracking, most Bitcoin ETFs employ authorized participants (APs)—typically large financial institutions—who can create or redeem large blocks of ETF shares (called “creation units”) in exchange for Bitcoin or cash. This creation/redemption mechanism helps keep the ETF’s market price aligned with its NAV and, by extension, with Bitcoin’s price.

The Regulatory Journey: From Rejection to Approval

The path to Bitcoin ETF approval was long and fraught with regulatory hurdles. For nearly a decade, the U.S. Securities and Exchange Commission (SEC) rejected numerous Bitcoin ETF applications, citing concerns about market manipulation, liquidity, valuation, and investor protection.

The first Bitcoin ETF application was filed by the Winklevoss twins in 2013, but it wasn’t until January 2024 that the SEC finally approved the first batch of spot Bitcoin ETFs. This watershed moment came after years of regulatory scrutiny, market maturation, and persistent efforts by asset managers to address the SEC’s concerns.

Several factors contributed to the eventual approval:

-

Market Maturation: The Bitcoin market grew significantly in size, liquidity, and institutional participation, addressing some of the SEC’s earlier concerns about market manipulation.

-

Regulatory Clarity: Clearer regulatory frameworks emerged for cryptocurrency activities, providing greater certainty for market participants.

-

Institutional Adoption: Major financial institutions entered the cryptocurrency space, lending credibility and bringing sophisticated risk management practices.

-

Court Rulings: Legal challenges to the SEC’s rejection of Bitcoin ETF applications created pressure for regulatory consistency.

-

Political Changes: The transition to a more crypto-friendly administration in the U.S. signaled a shift in regulatory approach.

The Significance of the 2024 Approvals and 2025 Expansion

The approval of spot Bitcoin ETFs in January 2024 marked a pivotal moment for cryptocurrency adoption. It signaled regulatory acceptance of Bitcoin as a legitimate asset class and opened the floodgates for institutional investment. Within weeks of approval, billions of dollars flowed into these funds, demonstrating pent-up demand from investors who had been waiting for a regulated vehicle to gain Bitcoin exposure.

The impact was immediate and profound. Bitcoin’s price surged past $100,000, setting new all-time highs. Trading volumes for Bitcoin ETFs consistently reached billions of dollars daily, rivaling some of the most popular ETFs in other asset classes. The success of Bitcoin ETFs paved the way for the approval of Ethereum ETFs later in 2024, and by 2025, the cryptocurrency ETF ecosystem had expanded significantly.

In 2025, we’ve witnessed further evolution of the Bitcoin ETF landscape, with more innovative products, lower fees due to competition, and greater institutional adoption. The approval of additional cryptocurrency ETFs for assets like Solana and XRP has further legitimized the broader cryptocurrency market, with Bitcoin ETFs serving as the foundation for this expanding ecosystem.

The journey from regulatory rejection to widespread adoption underscores the transformative potential of Bitcoin ETFs. They have bridged the gap between traditional finance and cryptocurrency markets, making Bitcoin accessible to a broader range of investors and potentially setting the stage for further integration of digital assets into the mainstream financial system.

The Current Bitcoin ETF Landscape in 2025

The Bitcoin ETF market has undergone remarkable growth and evolution since the first approvals in January 2024. What began as a watershed moment for cryptocurrency adoption has blossomed into a diverse ecosystem of investment products with billions of dollars under management. In 2025, the landscape offers investors unprecedented choice, liquidity, and access to Bitcoin through regulated vehicles. This section provides a comprehensive overview of the current Bitcoin ETF market, including major providers, performance metrics, fee structures, and trading dynamics.

Overview of Approved Bitcoin ETFs in the U.S. Market

As of 2025, the U.S. market hosts a robust selection of spot Bitcoin ETFs, each offering investors exposure to Bitcoin’s price movements through slightly different approaches. These funds have collectively transformed how institutions and retail investors access cryptocurrency markets, bringing Bitcoin into mainstream investment portfolios.

The approval wave that began in January 2024 has expanded to include numerous offerings from leading asset managers. These spot Bitcoin ETFs directly hold Bitcoin as their underlying asset, providing investors with pure exposure to the cryptocurrency without the need to manage digital wallets or private keys. The market has matured significantly, with established patterns of liquidity, competitive fee structures, and clear differentiation between offerings.

Detailed Breakdown of Major Providers and Their Market Share

The Bitcoin ETF market features several dominant players alongside smaller, specialized offerings. Here’s a detailed breakdown of the major providers and their respective market positions in 2025:

BlackRock iShares Bitcoin Trust (IBIT)

BlackRock’s entry into the Bitcoin ETF space has been nothing short of dominant. The iShares Bitcoin Trust (IBIT) has established itself as the market leader, holding approximately 570,500 Bitcoin, representing over 50% of the total Bitcoin held by U.S. ETFs. This commanding position reflects BlackRock’s reputation, distribution capabilities, and first-mover advantage in attracting institutional capital.

IBIT has accumulated over $6.96 billion in inflows in 2025 alone, surpassing many gold ETFs and demonstrating the strong demand for regulated Bitcoin exposure. The fund charges a competitive expense ratio of 0.25%, which has helped it attract cost-conscious investors. Its massive scale has also contributed to tight spreads and excellent liquidity, making it a preferred vehicle for both retail and institutional investors.

Fidelity Wise Origin Bitcoin Trust (FBTC)

Fidelity’s Bitcoin ETF has secured a strong second position in the market, holding approximately 197,700 Bitcoin, which translates to about 17.6% market share. Leveraging Fidelity’s extensive retail customer base and institutional relationships, FBTC has attracted significant assets despite intense competition.

The fund’s expense ratio of 0.25% matches BlackRock’s offering, and Fidelity’s established reputation for security and operational excellence has resonated with investors seeking a trusted name in the Bitcoin ETF space. Fidelity’s existing cryptocurrency infrastructure, developed through its digital assets subsidiary, has provided the fund with robust custody solutions and trading capabilities.

Grayscale Bitcoin Trust (GBTC)

The converted Grayscale Bitcoin Trust holds approximately 190,000 Bitcoin, representing about 16.6% of the market. As the oldest entity in the space, having existed as a closed-end fund before converting to an ETF structure, GBTC brought an established investor base to the Bitcoin ETF market.

However, GBTC’s higher expense ratio of 1.5% has been a competitive disadvantage, leading to significant outflows as investors migrated to lower-cost alternatives. Despite these challenges, Grayscale’s first-mover advantage and brand recognition in the cryptocurrency space have helped it maintain a substantial market position. The fund has also introduced a lower-cost offering, the Grayscale Bitcoin Mini Trust (BTC), which holds approximately 47,600 Bitcoin and charges a more competitive fee.

Other Significant Players

Several other asset managers have carved out meaningful positions in the Bitcoin ETF market:

-

ARK 21Shares Bitcoin ETF (ARKB): Managed by Cathie Wood’s ARK Invest in partnership with 21Shares, ARKB holds approximately 47,300 Bitcoin (4.2% market share). The fund has attracted investors drawn to ARK’s innovation-focused investment philosophy.

-

Bitwise Bitcoin ETP (BITB): With approximately 37,600 Bitcoin (3.4% market share), Bitwise has leveraged its cryptocurrency expertise and educational resources to attract investors seeking specialized knowledge alongside Bitcoin exposure.

-

VanEck Bitcoin Trust (HODL): Holding approximately 13,700 Bitcoin (1.2% market share), VanEck’s offering has appealed to the firm’s existing client base of institutional investors and financial advisors.

-

Smaller Providers: Valkyrie (BRRR), Invesco Galaxy (BTCO), Franklin Templeton (EZBC), and WisdomTree (BTCW) each maintain smaller but still significant positions in the market, collectively holding about 2.5% market share.

Fee Structures and Expense Ratios Comparison

Competition has driven a race to the bottom in fee structures, benefiting investors through lower costs. Here’s how the major Bitcoin ETFs compare in terms of expense ratios:

- Lowest Tier (0.20-0.25%): BlackRock IBIT (0.25%), Fidelity FBTC (0.25%), Bitwise BITB (0.20%), Franklin EZBC (0.19%)

- Mid Tier (0.30-0.50%): ARK 21Shares ARKB (0.35%), VanEck HODL (0.30%), Invesco Galaxy BTCO (0.39%)

- Higher Tier (0.50%+): Grayscale GBTC (1.5%), Valkyrie BRRR (0.80%)

Many providers initially launched with temporary fee waivers to attract assets, but by 2025, fee structures have largely stabilized. The intense competition has kept expense ratios relatively low compared to the early days of cryptocurrency funds, when fees of 2% or higher were common.

Trading Volumes and Liquidity Analysis

Bitcoin ETFs have established themselves as some of the most actively traded ETFs in the market. Daily trading volumes consistently reach billions of dollars, with IBIT alone often exceeding $1 billion in daily volume. This robust trading activity has several implications:

-

Tight Bid-Ask Spreads: High liquidity has resulted in narrow spreads, typically just a few basis points for the largest funds, reducing trading costs for investors.

-

Minimal Premium/Discount: The creation/redemption mechanism functions efficiently, keeping ETF prices closely aligned with their net asset values and, by extension, with Bitcoin’s spot price.

-

Institutional Accessibility: The depth of the market allows large institutions to establish or liquidate significant positions without excessive market impact.

-

Options Market Development: The liquidity of Bitcoin ETFs has supported the development of active options markets, providing additional tools for risk management and speculative strategies.

Trading volumes tend to spike during periods of high Bitcoin volatility, as investors use ETFs to quickly establish positions or hedge existing cryptocurrency exposure. The largest funds—particularly IBIT, FBTC, and GBTC—serve as the primary venues for institutional trading, while smaller funds often see more retail-oriented activity.

Performance Metrics Since Launch

Bitcoin ETFs have generally delivered strong performance since their launch, closely tracking Bitcoin’s price movements with minimal tracking error. Since January 2024, Bitcoin has experienced significant appreciation, surging past $100,000 and reaching new all-time highs in 2025.

The performance of spot Bitcoin ETFs has closely mirrored this trajectory, with slight variations due to fee differences and operational factors. For example, an investor who purchased shares of IBIT at its launch would have seen gains exceeding 60% by mid-2025, closely matching Bitcoin’s performance over the same period (minus the fund’s expense ratio).

Tracking error—the difference between the ETF’s returns and Bitcoin’s price movements—has been minimal for most spot Bitcoin ETFs, typically less than 1% annually. This tight tracking demonstrates the operational efficiency of these funds and their effectiveness as Bitcoin proxies.

In contrast, futures-based Bitcoin ETFs have exhibited higher tracking error due to the costs associated with rolling futures contracts and the potential divergence between futures and spot prices. This performance gap has reinforced the preference for spot Bitcoin ETFs among investors seeking pure Bitcoin exposure.

The current Bitcoin ETF landscape represents a mature, competitive market that has dramatically simplified cryptocurrency access for mainstream investors. With robust liquidity, reasonable fees, and effective price tracking, these investment vehicles have fulfilled their promise of bringing Bitcoin into traditional investment portfolios through familiar, regulated structures. As the market continues to evolve, competition among providers is likely to drive further innovations and cost reductions, benefiting investors seeking exposure to this transformative asset class.

Investment Strategies for Bitcoin ETFs in 2025

Investing in Bitcoin ETFs requires thoughtful strategy, especially given the volatile nature of cryptocurrency markets. While Bitcoin ETFs offer a more accessible and regulated way to gain exposure to Bitcoin, investors still need to consider how to approach these investments to align with their financial goals, risk tolerance, and investment horizon. This section explores various strategies for investing in Bitcoin ETFs in 2025, from allocation approaches to timing considerations and tax implications.

Dollar-Cost Averaging vs. Lump-Sum Investing

When investing in Bitcoin ETFs, one of the first strategic decisions involves choosing between dollar-cost averaging and lump-sum investing.

Dollar-Cost Averaging (DCA) involves investing a fixed amount at regular intervals, regardless of the ETF’s price. For example, investing $500 in a Bitcoin ETF on the first of every month. This approach offers several advantages:

- It reduces the impact of volatility and the risk of investing a large sum at an inopportune time

- It creates a disciplined investment habit, removing emotional decision-making

- It potentially lowers the average cost basis over time, especially in volatile markets

DCA has proven particularly effective for Bitcoin investments given the asset’s historical volatility. By spreading purchases over time, investors avoid the psychological stress of trying to time the market perfectly and can accumulate positions gradually as their confidence in the asset class grows.

Lump-Sum Investing, on the other hand, involves investing a larger amount all at once. Research has shown that lump-sum investing often outperforms DCA in markets with a long-term upward trajectory, as it maximizes time in the market. However, this approach requires:

- Greater risk tolerance, as the entire investment is immediately exposed to market fluctuations

- Confidence in the long-term value proposition of Bitcoin

- Psychological preparedness for potential short-term losses

For Bitcoin ETF investors in 2025, a hybrid approach might be optimal: allocating a portion of funds immediately to establish a position, then using DCA for additional investments. This balanced strategy provides immediate exposure while mitigating timing risk.

Portfolio Allocation Recommendations

Determining how much of your investment portfolio to allocate to Bitcoin ETFs is a critical decision that should reflect your risk tolerance, investment goals, and overall financial situation.

The 5% Rule: Many financial advisors recommend limiting cryptocurrency exposure to no more than 5% of an investment portfolio. This guideline, mentioned in sources like The Motley Fool, acknowledges Bitcoin’s potential for high returns while recognizing its significant volatility and speculative nature. For most conservative to moderate investors, this allocation provides meaningful exposure without risking overall financial stability.

Age-Based Allocation: Some investors adjust their Bitcoin ETF allocation based on age, with younger investors potentially taking larger positions (perhaps 5-10%) due to longer investment horizons and greater ability to weather volatility. Older investors nearing retirement might limit exposure to 1-3% of their portfolio.

Risk-Based Tiering: Another approach involves tiering allocation based on risk tolerance:

- Conservative investors: 1-3% allocation

- Moderate investors: 3-7% allocation

- Aggressive investors: 7-15% allocation

- Crypto enthusiasts: Up to 25% allocation (though this exceeds most traditional financial advice)

Rebalancing Considerations: Given Bitcoin’s volatility, regular portfolio rebalancing is essential. If Bitcoin ETFs perform exceptionally well, they may grow to represent a larger percentage of your portfolio than intended, increasing risk exposure. Establishing a quarterly or semi-annual rebalancing schedule helps maintain your target allocation.

Timing Strategies: Technical Analysis Considerations

While timing the market perfectly is notoriously difficult, some investors use technical analysis to inform their Bitcoin ETF investment decisions. In 2025, several technical indicators have proven useful for Bitcoin ETF investors:

Moving Averages: The 50-day and 200-day moving averages serve as important indicators. When the 50-day moving average crosses above the 200-day (a “golden cross”), it may signal a bullish trend. Conversely, when the 50-day crosses below the 200-day (a “death cross”), it might indicate a bearish trend.

Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. An RSI above 70 typically suggests that Bitcoin may be overbought, while an RSI below 30 indicates it may be oversold. These extremes can signal potential reversal points.

Support and Resistance Levels: Bitcoin has historically respected certain price levels as support (where downward trends tend to pause) and resistance (where upward trends tend to stall). In 2025, key psychological price levels include $100,000, $150,000, and $200,000.

Halving Cycles: Bitcoin undergoes “halving” events approximately every four years, reducing the rate at which new bitcoins are created. These events have historically preceded bull markets. Understanding where we stand in the halving cycle can provide context for potential price movements.

While these technical considerations can inform timing decisions, they should complement rather than replace a long-term investment strategy. Many successful Bitcoin ETF investors in 2025 use technical analysis to optimize entry points within a broader commitment to the asset class.

Long-Term Holding vs. Trading Strategies

Investors must decide whether to adopt a long-term holding strategy (often called “HODLing” in crypto parlance) or a more active trading approach with their Bitcoin ETF investments.

Long-Term Holding involves purchasing Bitcoin ETF shares with the intention of holding them for years or even decades, regardless of short-term price fluctuations. This approach:

- Aligns with the belief in Bitcoin’s long-term value proposition as “digital gold” or a store of value

- Reduces trading costs and potential tax implications

- Eliminates the stress of trying to time market movements

- Has historically outperformed most active trading strategies over multi-year periods

Active Trading Strategies involve more frequent buying and selling based on market conditions, technical indicators, or other factors. These approaches include:

- Swing Trading: Holding positions for days to weeks to capture “swings” in Bitcoin’s price

- Trend Following: Establishing positions in the direction of the prevailing trend

- Mean Reversion: Buying during significant dips and selling during substantial rallies, based on the theory that prices will revert to their mean

- Options Strategies: Using Bitcoin ETF options for income generation, hedging, or leveraged exposure

Active strategies require more time, expertise, and emotional discipline. They also typically incur higher transaction costs and tax liabilities. While some sophisticated investors successfully employ these approaches, research consistently shows that most retail investors underperform the market when actively trading.

For most Bitcoin ETF investors in 2025, a predominantly long-term holding strategy, perhaps complemented by small tactical adjustments during extreme market conditions, offers the best balance of potential returns and practical manageability.

Tax-Efficient Investing with Bitcoin ETFs

One of the significant advantages of Bitcoin ETFs over direct cryptocurrency ownership is their more straightforward tax treatment. However, maximizing tax efficiency still requires strategic planning.

Tax-Advantaged Accounts: Holding Bitcoin ETFs in tax-advantaged accounts like IRAs, Roth IRAs, or 401(k)s (where permitted) can shield gains from immediate taxation. In 2025, more retirement plans have begun allowing cryptocurrency ETF investments, creating new tax planning opportunities.

- Traditional IRAs/401(k)s: Tax-deferred growth, with taxes paid upon withdrawal

- Roth IRAs/401(k)s: Tax-free growth and withdrawals if holding requirements are met

- Health Savings Accounts (HSAs): Potentially triple tax advantages (tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses)

Tax-Loss Harvesting: Bitcoin’s volatility creates opportunities for tax-loss harvesting—selling investments at a loss to offset capital gains elsewhere in your portfolio. However, investors must be aware of wash sale rules, which prohibit claiming a loss if you purchase a “substantially identical” security within 30 days before or after the sale.

Long-Term vs. Short-Term Capital Gains: Holding Bitcoin ETF shares for more than one year before selling qualifies any gains for long-term capital gains treatment, which typically results in lower tax rates (0%, 15%, or 20% depending on income bracket) compared to short-term gains taxed as ordinary income.

ETF Structure Advantages: The in-kind creation/redemption mechanism of ETFs generally creates fewer taxable events than mutual funds, potentially resulting in greater tax efficiency for long-term holders.

Combining Bitcoin ETFs with Other Crypto Investments

For investors seeking broader cryptocurrency exposure, Bitcoin ETFs can serve as the foundation of a diversified crypto investment strategy.

Core-Satellite Approach: Using Bitcoin ETFs as the “core” (largest allocation) of your cryptocurrency exposure, while allocating smaller portions to other cryptocurrencies or crypto-related investments as “satellites.” This approach recognizes Bitcoin’s relative maturity and established position while allowing for exposure to other potential growth opportunities.

Multi-ETF Strategy: As the crypto ETF ecosystem expands in 2025, investors can combine Bitcoin ETFs with Ethereum ETFs and potentially other altcoin ETFs to create a diversified cryptocurrency portfolio through regulated vehicles.

Complementary Exposures: Some investors complement direct Bitcoin ETF holdings with:

- Cryptocurrency mining company stocks

- Blockchain technology ETFs

- Crypto exchange stocks

- Tokenized real-world assets

Risk Layering: Structuring cryptocurrency investments in layers of decreasing size and increasing risk:

- Layer 1 (largest allocation): Bitcoin ETFs

- Layer 2 (medium allocation): Ethereum ETFs

- Layer 3 (smaller allocation): Altcoin ETFs or direct altcoin investments

- Layer 4 (smallest allocation): Early-stage crypto projects or NFTs

This layered approach allows investors to participate in the broader cryptocurrency ecosystem while maintaining Bitcoin ETFs as the stable foundation of their strategy.

The optimal investment strategy for Bitcoin ETFs will vary based on individual circumstances, financial goals, and risk tolerance. By thoughtfully considering allocation, timing, holding periods, tax implications, and portfolio integration, investors can develop a personalized approach to Bitcoin ETF investing that aligns with their broader financial plan while providing exposure to this transformative asset class.

Risks and Considerations for Bitcoin ETF Investors

While Bitcoin ETFs have made cryptocurrency investing more accessible and regulated, they still carry significant risks that investors must carefully consider. Understanding these risks is essential for making informed investment decisions and setting appropriate expectations. This section explores the various challenges and considerations that Bitcoin ETF investors should keep in mind in 2025.

Volatility and Price Risk Assessment

Bitcoin’s price volatility remains one of its defining characteristics, even as the asset has matured. This volatility directly affects Bitcoin ETFs, which faithfully track the cryptocurrency’s price movements.

Historical data illustrates this volatility clearly. In just the past 12 months, Bitcoin has experienced price swings from lows below $54,000 to highs exceeding $106,000. Such dramatic fluctuations can occur within short timeframes, sometimes triggered by regulatory news, macroeconomic developments, or shifts in market sentiment.

For Bitcoin ETF investors, this volatility translates to significant price risk. The value of your investment can decrease substantially in a short period, potentially leading to significant losses if you need to sell during a downturn. This risk is particularly acute for investors who:

- Have a short investment horizon

- May need liquidity on short notice

- Have allocated an outsized portion of their portfolio to Bitcoin ETFs

- Are using leverage or margin to amplify exposure

While some investors view this volatility as an opportunity for potential gains, it’s important to recognize that Bitcoin ETFs are fundamentally different from traditional equity or fixed-income ETFs in terms of price stability. Even in 2025, with greater institutional participation and market maturity, Bitcoin remains significantly more volatile than traditional asset classes.

Regulatory Uncertainties and Potential Changes

The regulatory landscape for cryptocurrency continues to evolve, creating uncertainty for Bitcoin ETF investors. While the approval of spot Bitcoin ETFs in 2024 represented a significant regulatory milestone, the regulatory framework remains in flux.

Several regulatory considerations warrant attention:

Changing Administration Priorities: Political shifts can significantly impact cryptocurrency regulation. The more crypto-friendly Trump administration that took office in 2025 has eased some regulatory pressures, but future administrations might adopt different approaches. Regulatory attitudes toward cryptocurrency can change rapidly with new leadership at agencies like the SEC, CFTC, and Treasury Department.

Global Regulatory Divergence: Different countries continue to adopt varying approaches to cryptocurrency regulation. International regulatory developments can impact Bitcoin’s price and, by extension, Bitcoin ETF performance, especially if major economies implement restrictive policies.

Tax Policy Changes: The tax treatment of cryptocurrency investments remains subject to potential changes. Future tax legislation could alter how Bitcoin ETF investments are taxed, potentially affecting after-tax returns.

Custody and Security Requirements: Regulations governing how Bitcoin ETF providers secure and custody underlying Bitcoin holdings may evolve, potentially impacting operational costs and security practices.

Investors should stay informed about regulatory developments and consider how potential changes might affect their Bitcoin ETF investments. While regulatory clarity has improved significantly since 2024, the relatively young regulatory framework for cryptocurrency investments continues to develop.

Counterparty and Custodial Risks

Bitcoin ETFs introduce counterparty and custodial risks that differ from direct Bitcoin ownership. When you invest in a Bitcoin ETF, you’re relying on several entities:

ETF Provider: The financial institution that issues the ETF shares and manages the fund. The provider’s financial stability, operational competence, and corporate governance affect the ETF’s reliability.

Custodian: The entity responsible for securely storing the Bitcoin that backs the ETF. Most Bitcoin ETFs use specialized cryptocurrency custodians with robust security measures, but no system is entirely immune to risks.

Authorized Participants: Financial institutions that create and redeem ETF shares, helping to maintain the ETF’s price alignment with Bitcoin’s value. Their participation is crucial for the ETF’s proper functioning.

Exchange: The platform where ETF shares trade. Exchange-related risks include potential trading halts, technical issues, or liquidity constraints.

While these risks are generally well-managed by established financial institutions, they represent additional layers of complexity compared to direct Bitcoin ownership, where investors control their private keys. The trade-off is that these institutions provide regulatory compliance, security expertise, and operational infrastructure that many individual investors lack.

Technical Risks Related to the Bitcoin Network

Bitcoin ETFs are ultimately backed by Bitcoin itself, meaning they inherit certain technical risks associated with the Bitcoin network:

Protocol Vulnerabilities: While Bitcoin’s core protocol has proven remarkably resilient, the discovery of significant vulnerabilities could impact Bitcoin’s value and, consequently, Bitcoin ETF prices.

Network Attacks: Theoretical attacks on the Bitcoin network, such as 51% attacks (where an entity controls the majority of mining power), could undermine confidence in the system.

Scaling Challenges: As Bitcoin adoption grows, the network faces ongoing challenges related to transaction throughput and fees. How these challenges are addressed could affect Bitcoin’s utility and value proposition.

Fork Risks: Contentious changes to the Bitcoin protocol can result in forks, creating uncertainty about which version of Bitcoin ETFs should track. While major Bitcoin ETF providers have established policies for handling forks, these events can create temporary volatility and confusion.

Mining Concentration: Geographic or entity concentration in Bitcoin mining could raise concerns about centralization, potentially affecting market perception of Bitcoin’s decentralized nature.

While these technical risks have diminished as Bitcoin has matured, they remain important considerations for investors seeking to understand all factors that could affect their Bitcoin ETF investments.

Market Manipulation Concerns

Concerns about market manipulation in cryptocurrency markets have been a persistent issue, though improvements in market structure have reduced these risks over time. For Bitcoin ETF investors, several manipulation-related considerations remain relevant:

Spot Market Influence: Bitcoin ETF prices ultimately derive from spot Bitcoin markets, which may be susceptible to manipulation tactics like spoofing (placing and quickly canceling large orders) or wash trading (artificially inflating volume through self-trading).

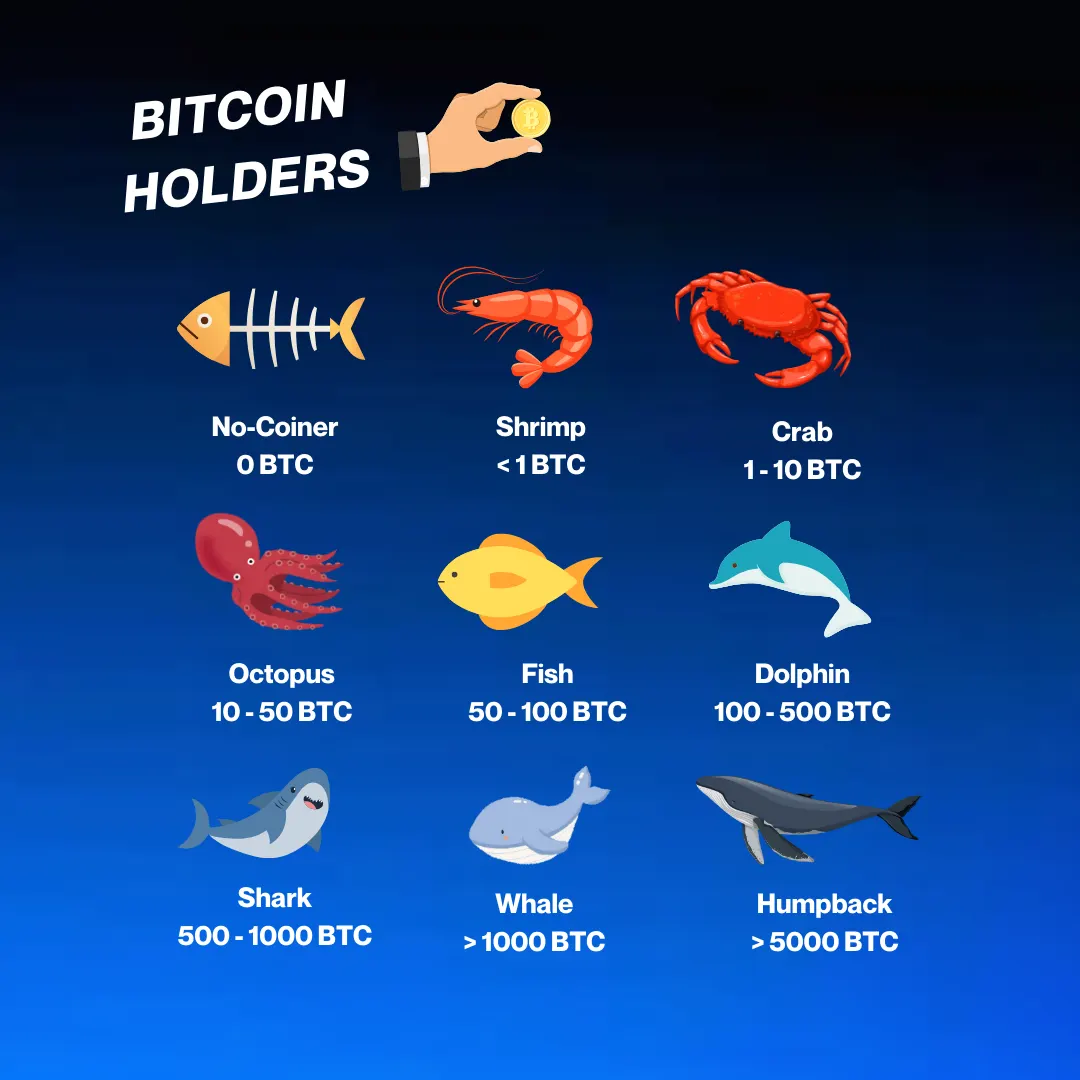

Whale Activity: Large Bitcoin holders (“whales”) can significantly impact prices through substantial buy or sell orders, potentially creating volatility that affects ETF values.

Market Fragmentation: Bitcoin trades across numerous exchanges globally, with varying levels of regulation and surveillance, creating opportunities for cross-market manipulation strategies.

Information Asymmetry: Some market participants may have access to non-public information or sophisticated trading capabilities that provide advantages over retail investors.

The growth of regulated Bitcoin ETFs has actually helped mitigate some manipulation concerns by increasing market transparency and institutional participation. However, the underlying cryptocurrency markets remain less regulated than traditional financial markets, creating persistent manipulation risks.

Psychological Challenges of Cryptocurrency Investing

Perhaps the most underappreciated risks in Bitcoin ETF investing are psychological. The extreme volatility and cultural aspects of cryptocurrency can trigger emotional responses that lead to poor investment decisions:

FOMO (Fear of Missing Out): During rapid price increases, investors may rush into Bitcoin ETFs without proper due diligence, fearing they’ll miss potential gains.

Panic Selling: Conversely, sharp price declines can trigger fear-based selling at market bottoms, locking in losses rather than maintaining a long-term perspective.

Overconfidence: Early success in Bitcoin investing can create overconfidence, potentially leading to excessive concentration or leverage.

Anchoring Bias: Investors often “anchor” to specific price points (like previous all-time highs), making decisions based on these reference points rather than fundamental analysis.

Narrative Chasing: The cryptocurrency space is rife with compelling narratives that can distract investors from objective assessment of risks and potential returns.

These psychological challenges can be particularly acute for Bitcoin ETF investors who are new to cryptocurrency’s extreme volatility. Developing a disciplined investment approach, clearly defined investment thesis, and realistic expectations can help mitigate these psychological risks.

Environmental and Social Considerations

Beyond financial risks, some investors consider environmental, social, and governance (ESG) factors when evaluating Bitcoin ETF investments:

Energy Consumption: Bitcoin mining requires significant energy consumption, raising environmental concerns. While the percentage of renewable energy used in Bitcoin mining has increased, the overall energy footprint remains substantial.

Carbon Footprint: Related to energy consumption, Bitcoin’s carbon emissions have been a point of criticism, though estimates vary widely depending on methodology and assumptions about energy sources.

Social Impact: Perspectives on Bitcoin’s social impact range from viewing it as a tool for financial inclusion and freedom to concerns about its use in illicit activities or potential exacerbation of wealth inequality.

Governance Questions: Bitcoin’s decentralized governance model, while a feature for many supporters, raises questions about accountability and decision-making processes for some institutional investors.

For investors who prioritize ESG considerations, these factors may influence decisions about Bitcoin ETF investments. Some may choose to limit exposure or select ETF providers that emphasize renewable energy usage in their Bitcoin mining partnerships.

Understanding and carefully weighing these various risks is essential for responsible Bitcoin ETF investing. While these investment vehicles have made cryptocurrency more accessible, they haven’t eliminated the underlying risks associated with this emerging asset class. By approaching Bitcoin ETF investments with clear-eyed risk awareness, investors can make more informed decisions aligned with their financial goals and risk tolerance.

Future Outlook: What’s Next for Bitcoin ETFs?

As Bitcoin ETFs continue to mature and evolve in 2025, investors are increasingly looking toward the future of these investment vehicles and their potential impact on both cryptocurrency markets and traditional finance. This section explores emerging trends, potential innovations, and long-term considerations that may shape the Bitcoin ETF landscape in the coming years.

Potential Innovations in Bitcoin ETF Products

The first generation of Bitcoin ETFs focused primarily on providing straightforward exposure to Bitcoin’s price movements. As the market matures, we’re beginning to see product innovations that could expand the utility and appeal of these investment vehicles:

Actively Managed Bitcoin ETFs: While current Bitcoin ETFs are passively managed, tracking Bitcoin’s price, future products may incorporate active management strategies. These could include tactical allocation between Bitcoin and cash based on market conditions, or selective participation in Bitcoin forks and airdrops.

Leveraged and Inverse Bitcoin ETFs: For sophisticated investors, leveraged ETFs offering 2x or 3x exposure to Bitcoin’s daily price movements, as well as inverse ETFs that move in the opposite direction of Bitcoin, could provide additional tools for expressing market views or hedging existing positions.

Bitcoin ETFs with Yield Components: Innovative structures that incorporate yield-generating activities like Bitcoin lending or staking could appeal to income-focused investors. These products would balance the potential for yield against additional risks.

Options-Based Bitcoin ETF Strategies: ETFs employing options strategies on Bitcoin futures or ETF shares could offer modified risk-return profiles, such as reduced volatility in exchange for capped upside, or enhanced income through option premium collection.

Bitcoin ETFs with Insurance Features: To address volatility concerns, some providers may develop products with downside protection features, potentially using options strategies or other mechanisms to provide partial protection against significant price declines.

Tax-Optimized Bitcoin ETF Structures: As the regulatory environment evolves, we may see ETF structures specifically designed to optimize tax treatment for cryptocurrency exposure, potentially addressing issues like wash sale rules or capital gains treatment.

Global Expansion of Bitcoin ETF Availability

While the United States has become a leader in Bitcoin ETF adoption following the 2024 approvals, the global landscape for these products continues to develop unevenly:

European Market Development: European regulators have taken a more cautious approach to spot Bitcoin ETFs, though several exchange-traded products (ETPs) with similar characteristics are available. Full regulatory alignment across European jurisdictions could unlock significant additional demand.

Asian Market Potential: Countries like Singapore, Japan, and South Korea are developing regulatory frameworks that could eventually accommodate Bitcoin ETFs, potentially opening these markets to substantial institutional capital.

Emerging Market Adoption: Some emerging markets with currency instability or capital controls may see particular demand for Bitcoin exposure through regulated vehicles, though regulatory approaches vary widely.

Global Regulatory Convergence: Over time, we may see greater harmonization of regulatory approaches to Bitcoin ETFs across major financial centers, potentially creating a more consistent global market for these products.

The expansion of Bitcoin ETF availability globally could significantly increase the total capital flowing into these vehicles, potentially supporting Bitcoin’s price and further legitimizing it as an institutional asset class.

Integration with Traditional Financial Products

As Bitcoin ETFs become more established, we’re likely to see increasing integration with traditional financial products and services:

Inclusion in Model Portfolios: Financial advisors and robo-advisors are beginning to incorporate Bitcoin ETFs into model portfolios, typically as a small allocation within alternative investments. This trend could accelerate as comfort with the asset class grows.

Integration with Target-Date Funds: Some retirement-focused products may begin to include small Bitcoin ETF allocations, particularly for younger investors with longer time horizons.

Bitcoin ETFs in 401(k) Plans: While still controversial, the availability of Bitcoin ETFs in retirement plans is expanding, with more plan sponsors considering offering these options to participants.

ETF of ETFs Including Bitcoin Exposure: Multi-asset ETFs that include Bitcoin ETFs alongside traditional assets could provide simplified diversification for investors seeking managed cryptocurrency exposure.

Bitcoin ETFs in Insurance Products: Variable annuities and other insurance-based investment products may increasingly offer Bitcoin ETF options, providing tax-advantaged exposure for certain investors.

This integration with mainstream financial products could significantly broaden the investor base for Bitcoin ETFs beyond those specifically seeking cryptocurrency exposure.

The Impact of Future Bitcoin Halvings on ETF Performance

Bitcoin’s programmed supply schedule includes “halving” events approximately every four years, when the reward for mining new blocks is cut in half. These events reduce the rate at which new bitcoins enter circulation, potentially affecting supply-demand dynamics.

Historically, Bitcoin halvings have preceded significant bull markets, though the causal relationship remains debated. For Bitcoin ETF investors, understanding this cyclical pattern may provide context for long-term investment planning:

Next Halving Expectations: The next Bitcoin halving is expected in 2028, reducing the block reward from 3.125 to 1.5625 bitcoins. If historical patterns hold, this could coincide with increased price appreciation, benefiting ETF holders.

Diminishing Impact Theory: Some analysts suggest that as Bitcoin’s market capitalization grows, the impact of each halving on price may diminish, as the reduction in new supply represents a smaller percentage of the total circulating supply.

Institutional Response to Halvings: Unlike previous halvings, future events will occur in a market with significant institutional participation through ETFs. This could alter market dynamics, potentially reducing volatility around these events.

Long-Term Supply Implications: As Bitcoin approaches its maximum supply of 21 million coins, the economics of the network will shift entirely to transaction fees rather than block rewards. This transition may have profound implications for Bitcoin’s value proposition and, by extension, ETF performance.

Bitcoin ETF investors should consider these supply dynamics as part of their long-term investment thesis, recognizing both the historical patterns and the potential for evolving market responses.

Long-Term Adoption Scenarios

Looking beyond immediate product innovations and market developments, several long-term adoption scenarios could shape the future of Bitcoin ETFs:

Mainstream Allocation Scenario: In this scenario, Bitcoin ETFs become a standard, albeit small, allocation in mainstream investment portfolios (typically 1-5%). This would represent a significant expansion from current adoption levels and could support sustained demand for these products.

Digital Gold Realization: If Bitcoin firmly establishes itself as “digital gold” and captures a meaningful portion of gold’s market share as a store of value, Bitcoin ETFs could see dramatic growth, potentially rivaling gold ETFs in assets under management.

Central Bank Digital Currency Impact: The development and adoption of central bank digital currencies (CBDCs) could either compete with or complement Bitcoin’s value proposition, with corresponding effects on ETF demand.

Technological Disruption Risk: Advances in quantum computing or other technologies could theoretically pose challenges to Bitcoin’s security model, creating risks for long-term holders, including ETF investors.

Regulatory Backlash Scenario: While the regulatory environment has become more accommodating, a reversal of this trend in major economies could significantly impact Bitcoin ETF viability and performance.

The most likely outcome may involve elements of multiple scenarios, with adoption proceeding unevenly across different investor segments and geographic regions.

Expert Perspectives on the Future of Bitcoin ETFs

Financial experts and cryptocurrency analysts offer varying perspectives on the future of Bitcoin ETFs:

Michael Saylor, one of Bitcoin’s most prominent advocates, has projected potential Bitcoin valuations reaching $13 million by 2045 in his base case, and up to $49 million in his bull case. While these projections are extraordinarily optimistic, they reflect a view that Bitcoin will continue to gain adoption as a global monetary asset.

More moderate projections from traditional financial institutions suggest Bitcoin could reach $150,000 to $200,000 by late 2025, supported by ETF inflows and broader institutional adoption. These projections typically assume Bitcoin captures a small percentage of global store of value and alternative investment allocations.

Skeptical perspectives emphasize Bitcoin’s lack of intrinsic value and potential regulatory challenges, suggesting that current ETF enthusiasm could wane if cryptocurrency regulations tighten or if Bitcoin fails to deliver on its promise as a store of value.

The diversity of expert opinions reflects the still-speculative nature of Bitcoin as an asset class, despite its increasing institutionalization through ETFs.

The future of Bitcoin ETFs will likely be shaped by a complex interplay of technological developments, regulatory decisions, institutional adoption patterns, and evolving investor preferences. While uncertainty remains, the establishment of regulated Bitcoin ETFs represents a significant milestone in cryptocurrency’s journey toward mainstream financial acceptance. For investors, staying informed about these evolving dynamics will be essential for navigating this innovative but still-maturing investment category.

Conclusion: Navigating the Bitcoin ETF Landscape in 2025

As we’ve explored throughout this comprehensive guide, Bitcoin ETFs represent a transformative development in cryptocurrency investing, bridging the gap between traditional finance and the digital asset frontier. In 2025, these investment vehicles have matured into established financial products, offering investors regulated, accessible exposure to Bitcoin without the technical complexities of direct cryptocurrency ownership.

The journey to this point has been remarkable. From years of regulatory rejection to the watershed approvals in January 2024, Bitcoin ETFs have overcome significant hurdles to become legitimate investment options for both retail and institutional investors. The impact has been profound, with billions of dollars flowing into these funds, contributing to Bitcoin’s price appreciation and broader market maturation.

For investors considering Bitcoin ETF investments, several key takeaways emerge from our analysis:

Diversification and Allocation: Bitcoin ETFs can serve as a diversifying element within a broader investment portfolio, potentially offering returns uncorrelated with traditional assets. However, prudent allocation remains essential—most financial advisors recommend limiting cryptocurrency exposure to no more than 5% of your investment portfolio, acknowledging both the potential upside and significant volatility of this asset class.

Provider Selection Matters: Not all Bitcoin ETFs are created equal. Differences in fee structures, assets under management, tracking accuracy, and trading liquidity can significantly impact your investment experience. Taking time to compare options and select the ETF that best aligns with your investment goals can enhance long-term results.

Strategy Alignment: Whether you adopt a dollar-cost averaging approach to mitigate timing risk, a long-term holding strategy to ride out volatility, or a more active trading approach, ensuring your Bitcoin ETF strategy aligns with your broader investment philosophy and risk tolerance is crucial for success.

Risk Awareness: Despite the regulated nature of ETFs, Bitcoin remains a volatile, speculative asset. Understanding the full spectrum of risks—from price volatility and regulatory uncertainty to technical and psychological challenges—is essential for setting realistic expectations and making informed decisions.

Future Potential: The Bitcoin ETF ecosystem continues to evolve, with potential innovations in product structures, global expansion, and integration with traditional financial services. Staying informed about these developments can help investors identify new opportunities and navigate changing market dynamics.

For many investors, Bitcoin ETFs represent an optimal middle ground—offering exposure to Bitcoin’s potential upside while mitigating many of the technical, security, and regulatory concerns associated with direct cryptocurrency ownership. They provide a familiar, regulated vehicle for participating in what many consider a transformative asset class.

However, it’s important to approach Bitcoin ETF investments with clear eyes and realistic expectations. While Bitcoin has delivered extraordinary returns over its history, past performance doesn’t guarantee future results. The asset remains speculative, and its long-term value proposition continues to be debated among financial experts.

As with any investment decision, personal research, careful consideration of your financial goals and risk tolerance, and potentially consultation with financial professionals are recommended before making significant Bitcoin ETF investments. By approaching these innovative investment vehicles with both enthusiasm and prudence, investors can potentially benefit from cryptocurrency exposure while managing the associated risks.

The emergence and growth of Bitcoin ETFs mark a significant milestone in the ongoing integration of cryptocurrency into the mainstream financial system. Whether this represents the early stages of a fundamental shift in global finance or simply the addition of a new alternative asset class remains to be seen. What’s clear is that Bitcoin ETFs have created new possibilities for investors seeking to navigate the evolving landscape of digital assets in a regulated, accessible manner.

As we look toward the future, one thing is certain: the Bitcoin ETF story is still being written. For investors willing to engage with this innovative but volatile asset class, understanding the fundamentals covered in this guide provides a foundation for making informed decisions in this dynamic and evolving market.

Disclaimer: Not Financial Advice

This article is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any specific cryptocurrency. Investing in cryptocurrencies, particularly penny cryptocurrencies, is highly speculative and carries a substantial risk of loss. Past performance is not indicative of future results. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. The author and publisher of this article are not responsible for any financial losses incurred as a result of decisions made based on the information provided herein. The cryptocurrency market is volatile, and you could lose your entire investment.

RELATED POSTS

View all