A General Guide Amidst Data Limitations

Introduction: The Quest for Short-Term Crypto Gains

The allure of quick profits in the dynamic world of cryptocurrency often leads to the question: what is the best cryptocurrency to invest in today for short-term gains? Investors and enthusiasts are constantly seeking the next coin poised for a rapid ascent. This article aims to explore considerations for short-term cryptocurrency investment. However, it is crucial to preface this discussion with a note on data availability. Initial attempts to identify specific, currently trending cryptocurrencies using real-time data from sources like Google Trends and Twitter API queries for terms such as ‘cryptocurrency,’ ‘Bitcoin,’ ‘Ethereum,’ ‘Solana,’ and ‘Dogecoin’ did not yield significant, actionable trend data at the time of this research (mid-May 2025). This could be due to various factors, including API limitations, diffuse online discussions, or a temporary lull in specific coin-focused hype.

Therefore, rather than pinpointing specific coins based on elusive real-time trends, this article will provide a more general guide. We will delve into the factors to consider, common (though high-risk) strategies, and the significant risks inherent in short-term cryptocurrency ventures. This information is intended for educational purposes and should not be construed as financial advice. The cryptocurrency market is exceptionally volatile, and any investment decision should be made with caution and ideally after consultation with a qualified financial advisor.

Factors to Consider for Short-Term Cryptocurrency Investments

Identifying potential candidates for short-term investment in the cryptocurrency market requires careful research and an understanding of various influencing factors. Given the absence of strong, specific trending signals from the aforementioned data sources, a broader approach to evaluation becomes necessary. One primary factor is market sentiment and news. Even without pinpointing a single trending coin, general market sentiment can offer clues. Positive news regarding a specific project, technological breakthroughs, new partnerships, or even broader regulatory developments can significantly impact prices in the short term. Conversely, negative news can trigger rapid declines. Investors should stay abreast of developments through reputable crypto news outlets, project communication channels (like official blogs or social media), and community forums, always cross-referencing information to avoid misinformation.

Another critical aspect is project fundamentals, even for short-term plays. While long-term viability might seem less relevant for a quick flip, a project with a solid use case, a competent development team, and transparent communication is generally less susceptible to sudden collapses compared to purely speculative meme coins with no underlying value. Examining a project’s whitepaper, its technological underpinnings, the problem it aims to solve, and its tokenomics (the structure of its coin supply, distribution, and utility) can provide insights into its potential resilience and appeal. High trading volume is also a key indicator for short-term traders. A cryptocurrency with significant daily trading volume generally offers better liquidity, meaning it’s easier to buy and sell without drastically affecting the price. Low-volume coins can be difficult to offload quickly, especially in large amounts, and are more susceptible to price manipulation.

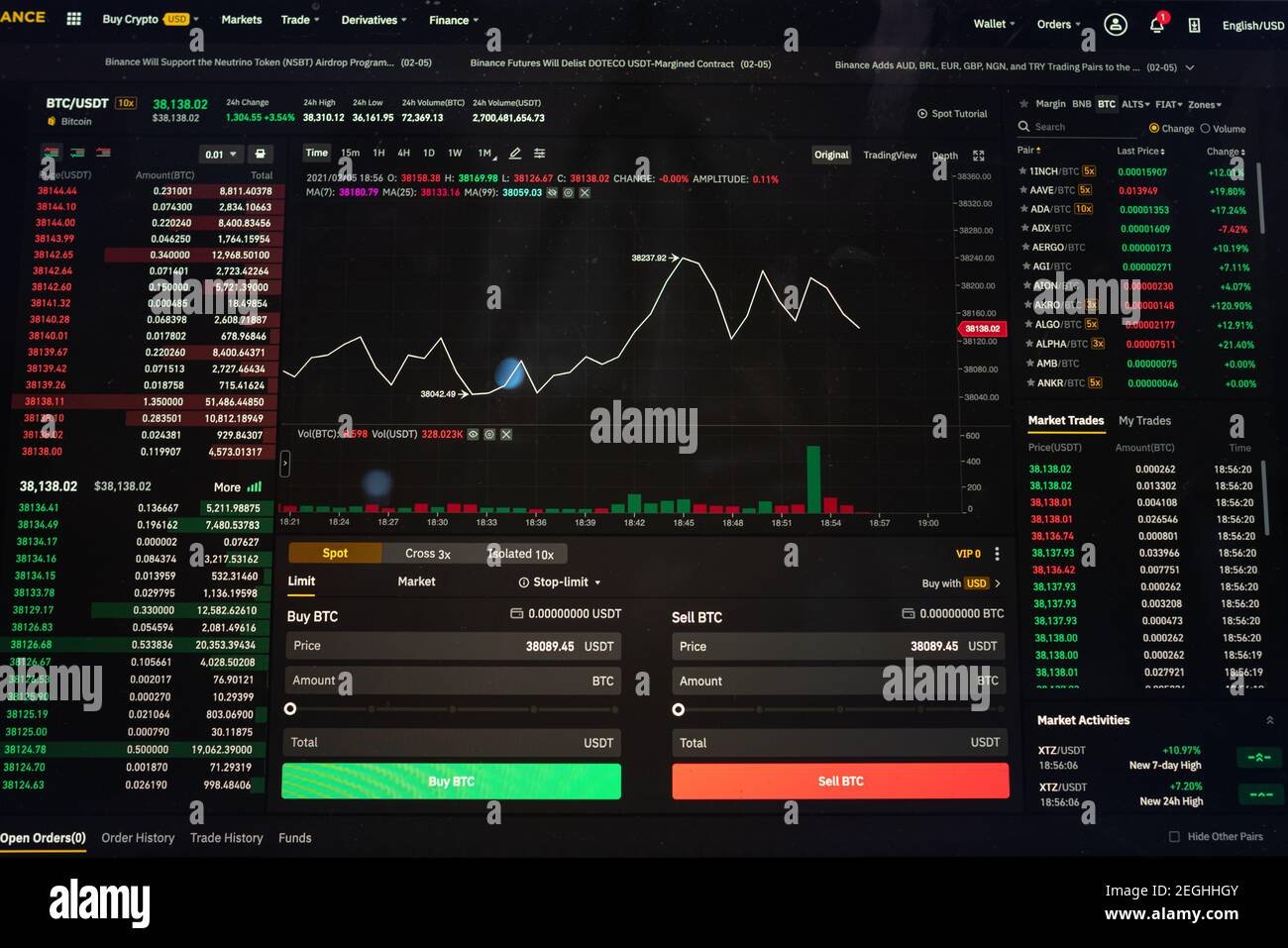

Technical analysis plays a significant role for many short-term traders. This involves studying price charts and trading patterns to identify potential entry and exit points. Indicators such as moving averages, Relative Strength Index (RSI), MACD (Moving Average Convergence Divergence), and support/resistance levels are commonly used. While technical analysis is not a foolproof predictor of future price movements, it can provide a framework for making trading decisions. However, it requires considerable learning and practice to use effectively, and its efficacy can be debated, especially in highly volatile and news-driven markets like cryptocurrency.

Community strength and engagement can also be a short-term driver. A vibrant and active community around a cryptocurrency can indicate strong interest and support, potentially leading to increased demand and price appreciation. This can be gauged through social media activity (though specific trend data was limited in our query, general activity levels can be observed), online forums like Reddit, and Telegram or Discord groups. However, it’s important to distinguish genuine community engagement from artificially inflated hype or ‘shilling’.

Common Short-Term Strategies (and Their High Risks)

Several strategies are employed by those seeking short-term gains in the cryptocurrency market, each carrying substantial risk. Day trading involves making multiple trades within a single day, aiming to profit from small price fluctuations. This strategy requires constant market monitoring, quick decision-making, and a deep understanding of technical analysis and market dynamics. The transaction costs (fees) can also eat into profits significantly.

Swing trading typically involves holding assets for a few days or weeks to capitalize on anticipated price ‘swings.’ Swing traders often use a combination of technical and fundamental analysis to identify potential medium-term trends. While less frenetic than day trading, it still requires active management and a good grasp of market cycles.

Another approach, particularly prevalent in the crypto space, is investing in Initial Coin Offerings (ICOs), Initial DEX Offerings (IDOs), or newly listed tokens. The idea is to get in early on a promising project before its value potentially increases significantly. However, this is one of the riskiest areas of cryptocurrency investment. Many new projects fail, and scams (rug pulls) are unfortunately common. Thorough due diligence is paramount, but even then, the chances of success are often slim.

The Inherent and Significant Risks of Short-Term Crypto Ventures

It cannot be overstated that short-term cryptocurrency investment is fraught with risk. The primary risk is extreme price volatility. Cryptocurrencies can experience dramatic price swings in very short periods, often without clear reasons. This means that while there’s potential for rapid gains, there’s an equally high, if not higher, potential for substantial losses. Investors should only risk capital they can afford to lose entirely.

Lack of regulation in many jurisdictions means that investors often have little recourse in case of fraud or market manipulation. While regulatory landscapes are evolving, the crypto market remains, in many ways, a ‘Wild West’ environment. This also contributes to the risk of scams and security breaches. Fake projects, phishing attacks, and exchange hacks are persistent threats. Protecting one’s digital assets through secure wallet practices and vigilance is crucial.

Furthermore, the speculative nature of many cryptocurrencies means their prices are often driven by hype and market sentiment rather than underlying fundamental value. This makes them particularly susceptible to bubbles and subsequent crashes. What is ‘trending’ today can be forgotten tomorrow, leaving latecomers with significant losses.

Conclusion: Navigating with Caution

In conclusion, while the prospect of identifying the ‘best’ cryptocurrency for short-term investment today is enticing, the reality is complex and high-risk, especially when clear, specific real-time trend data is elusive. Instead of chasing fleeting trends, a more prudent approach involves understanding the general factors that can influence short-term price movements, such as news, project fundamentals, trading volume, and market sentiment. Common short-term strategies exist but come with exceptionally high risks due to market volatility, regulatory uncertainties, and the prevalence of speculative activities.

This article has aimed to provide a general overview of these considerations. It is not financial advice. Anyone considering short-term cryptocurrency investments must conduct thorough personal research, understand the significant risks involved, and never invest more than they can afford to lose. Consulting with a qualified and independent financial advisor before making any investment decisions in this volatile market is strongly recommended.

References:

- (Note: As specific trending data was not found, direct references to live trend sources are not applicable. General references would include reputable crypto news sites like CoinDesk, Cointelegraph, project whitepapers, and official project communication channels.)

Disclaimer

The information provided in this article is for general informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. You should not treat any of the website’s content as such. Bestcryptonewz.com does not recommend that any cryptocurrency should be bought, sold, or held by you. Cryptocurrencies are highly volatile financial assets, and you should conduct your own due diligence (DYOR) and consult your financial advisor before making any investment decisions. Investing in cryptocurrencies involves a significant risk of loss, and past performance is not indicative of future results. You could lose your entire investment. Bestcryptonewz.com and its authors are not responsible for any investment decisions you make based on the information provided on this website.

RELATED POSTS

View all